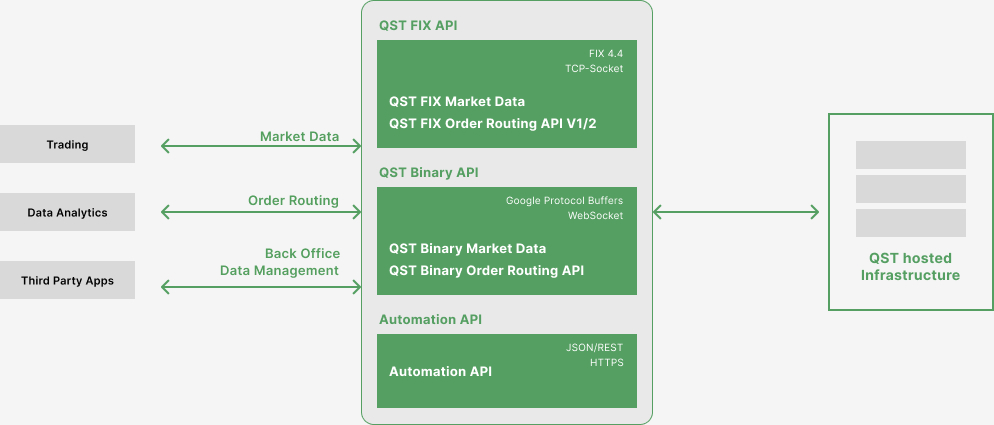

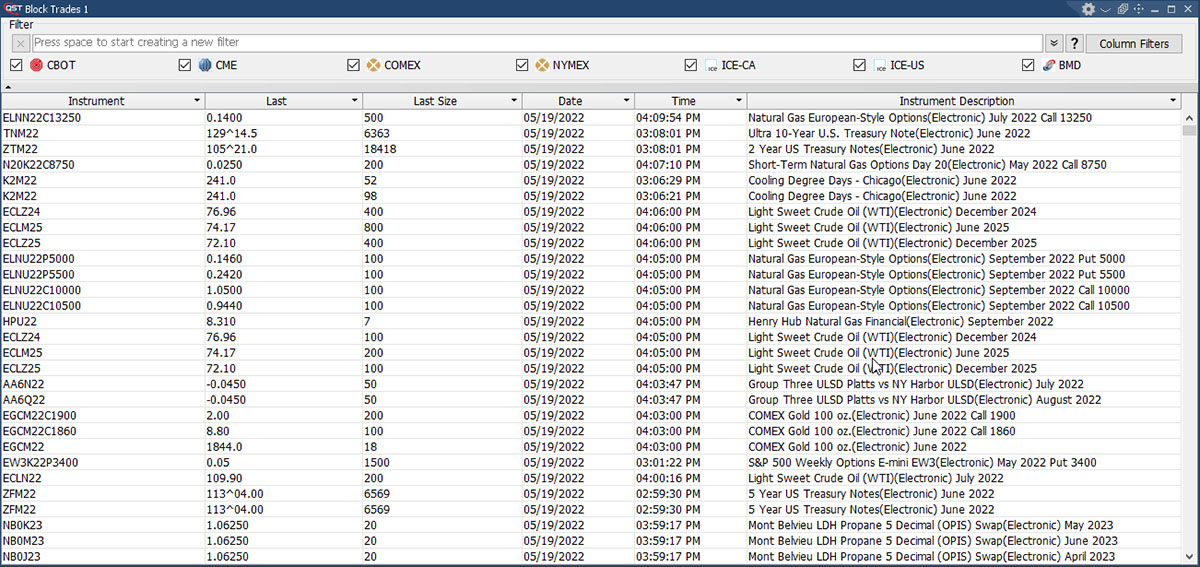

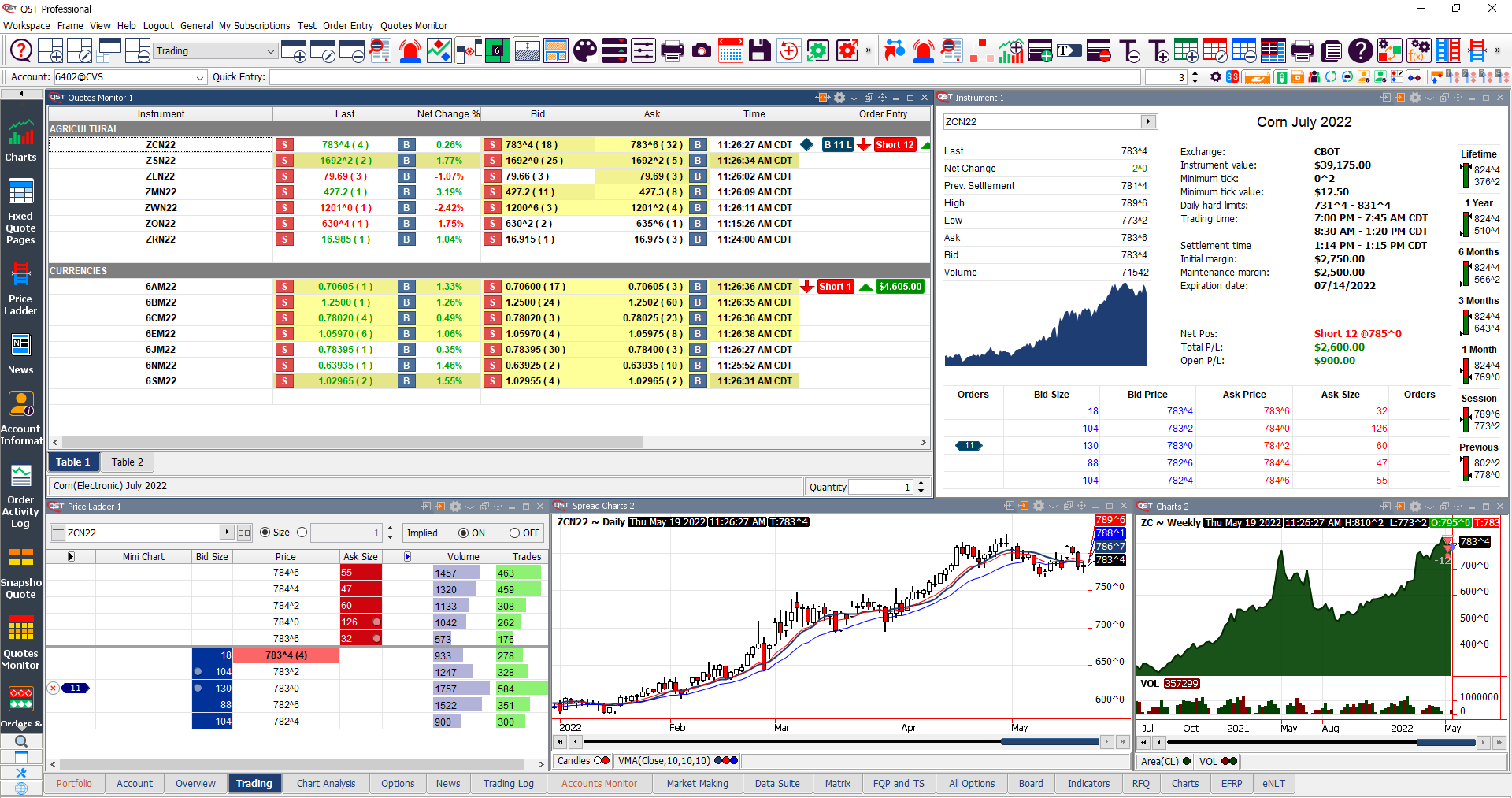

QAPI provides multiple interfaces for order management, market data and workflow automation

The power of QST into

your platform

your platform

Our QAPI infrastructure is built on end-to-end 10GB ethernet connectivity, as well as a mix of Intel and AMD hardware.

QAPI users can connect via virtualized Windows, OSX, or Linux-based server or bare metal within our data center.

Seamless Integration

Combined with our low-latency pre-trade risk controls, this offers automated traders a flexible range of price and latency options.

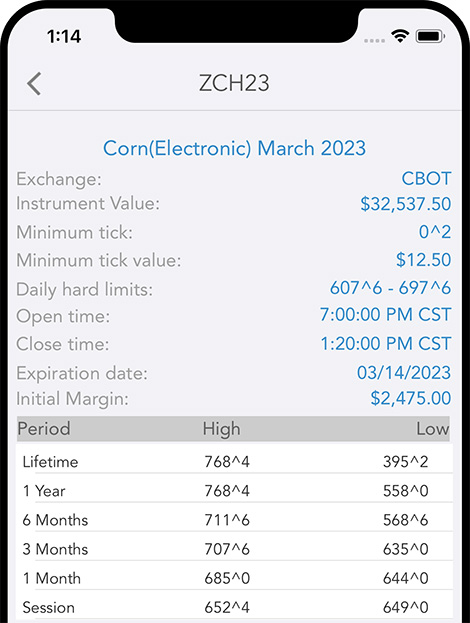

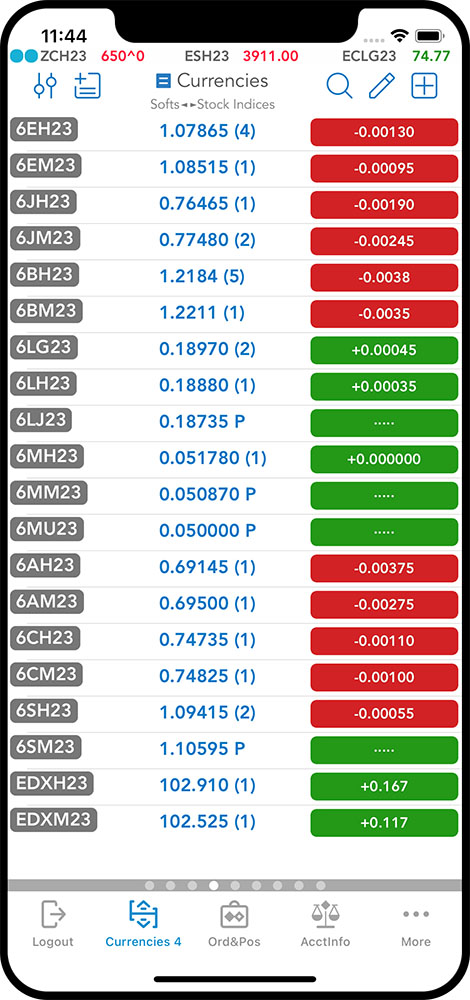

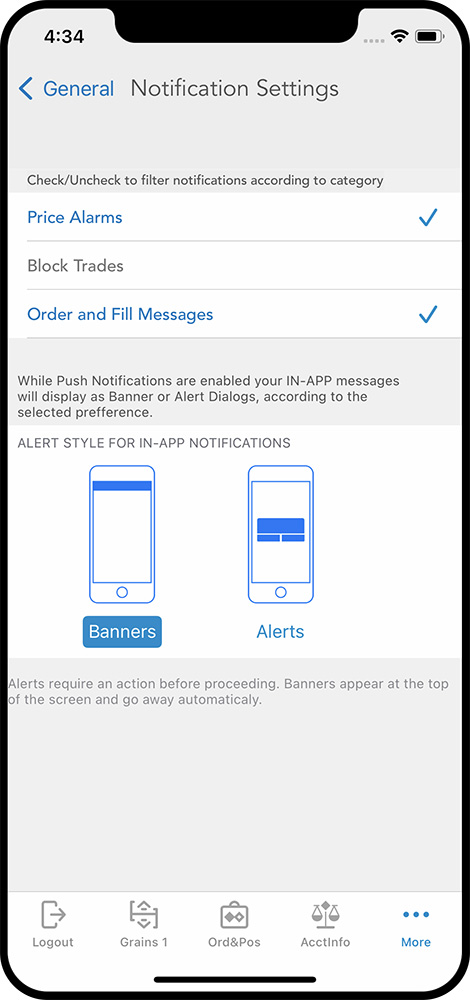

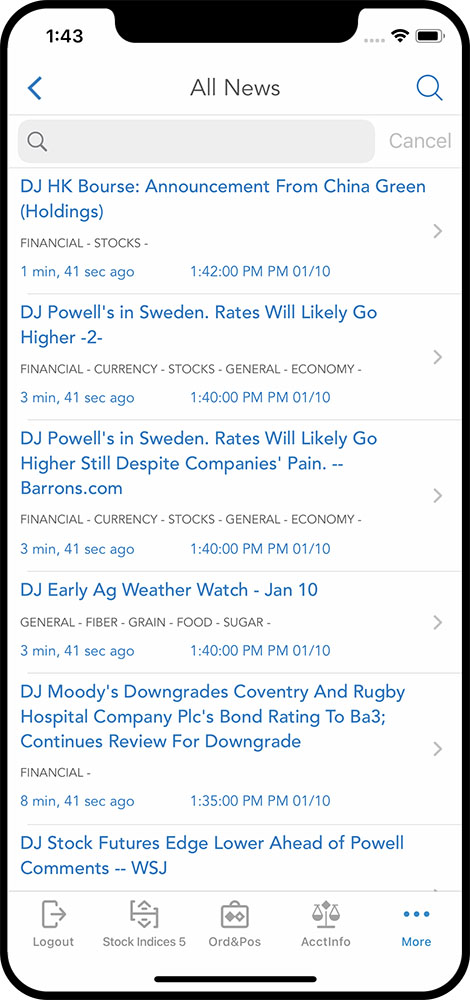

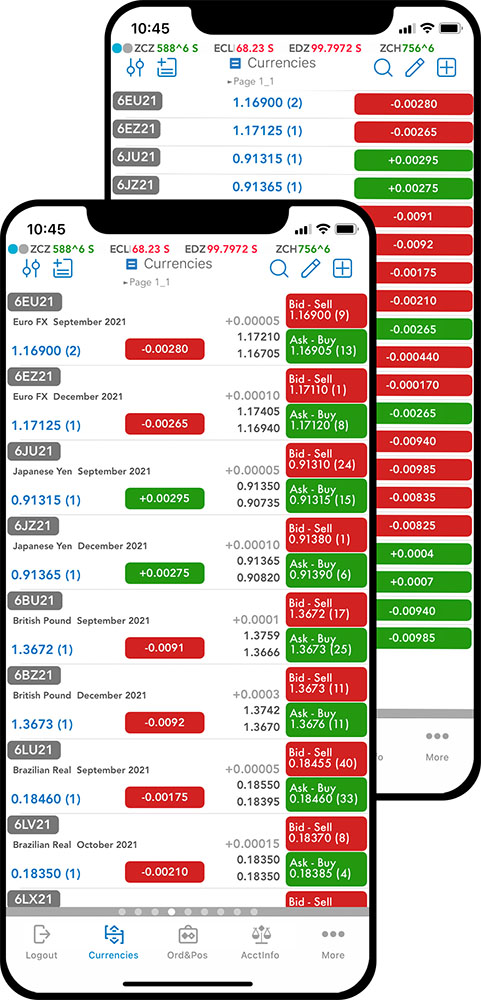

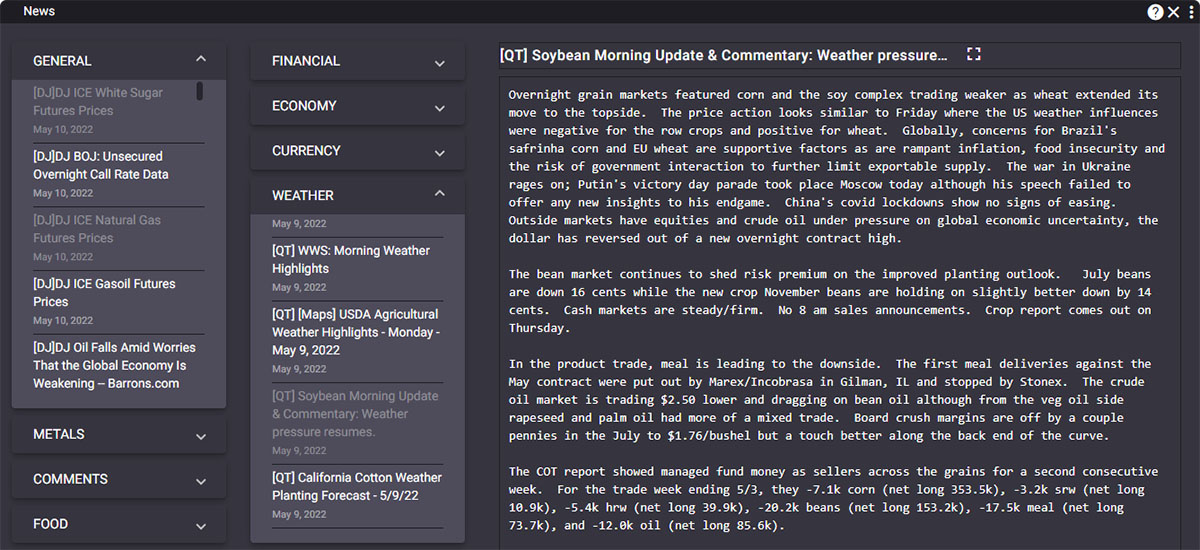

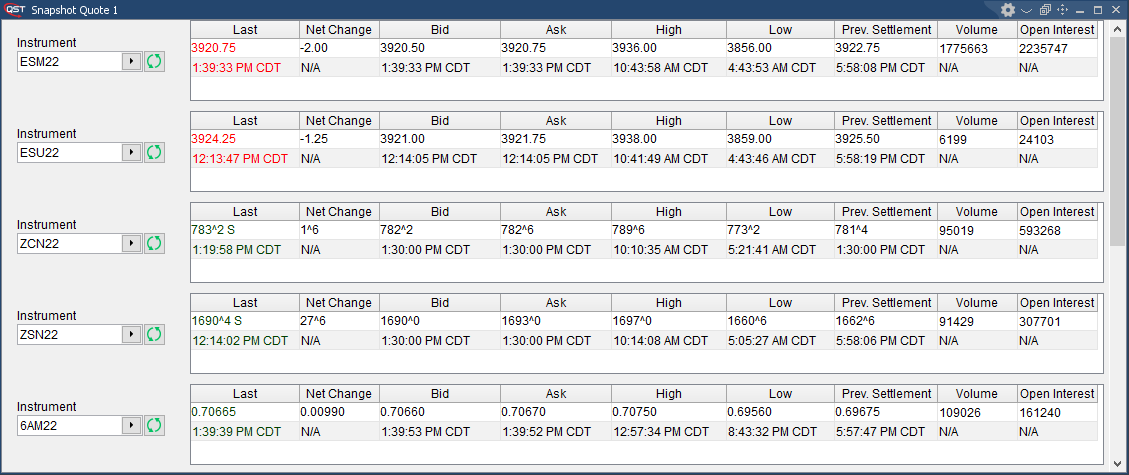

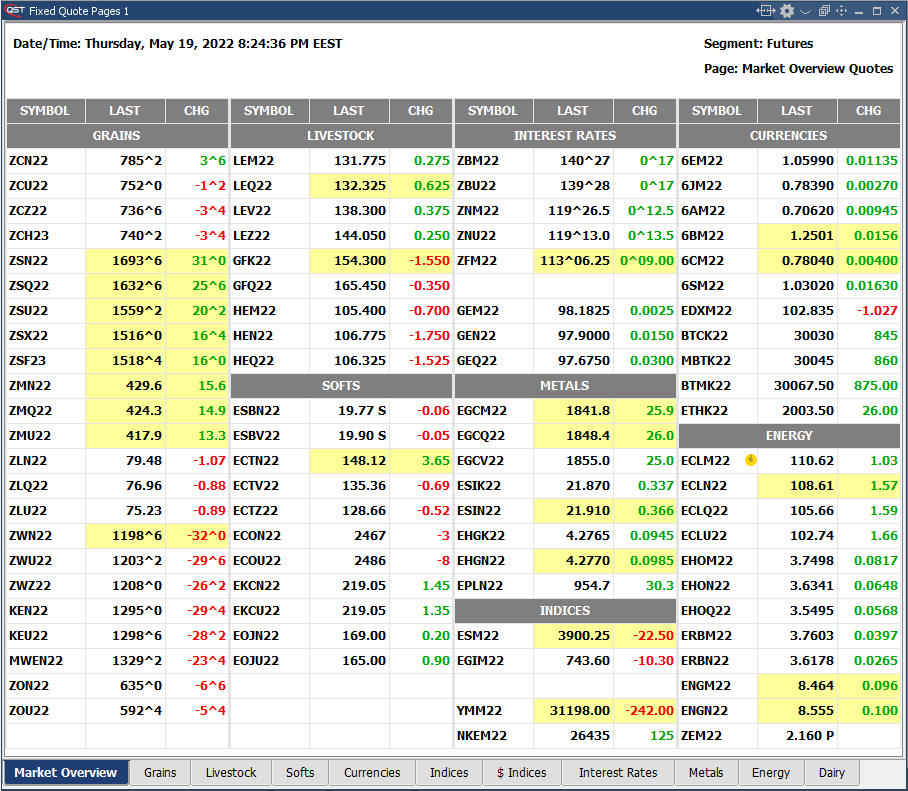

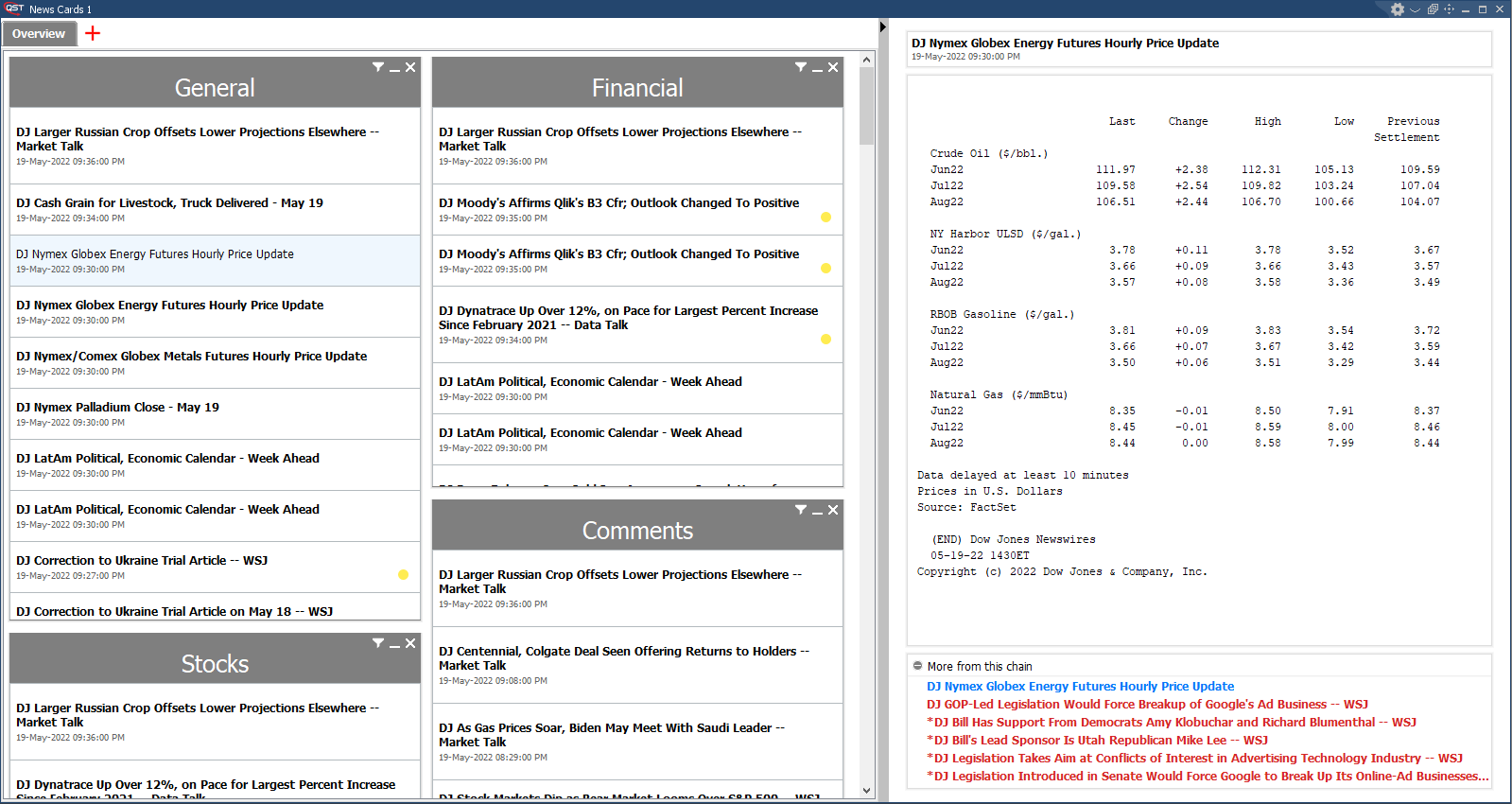

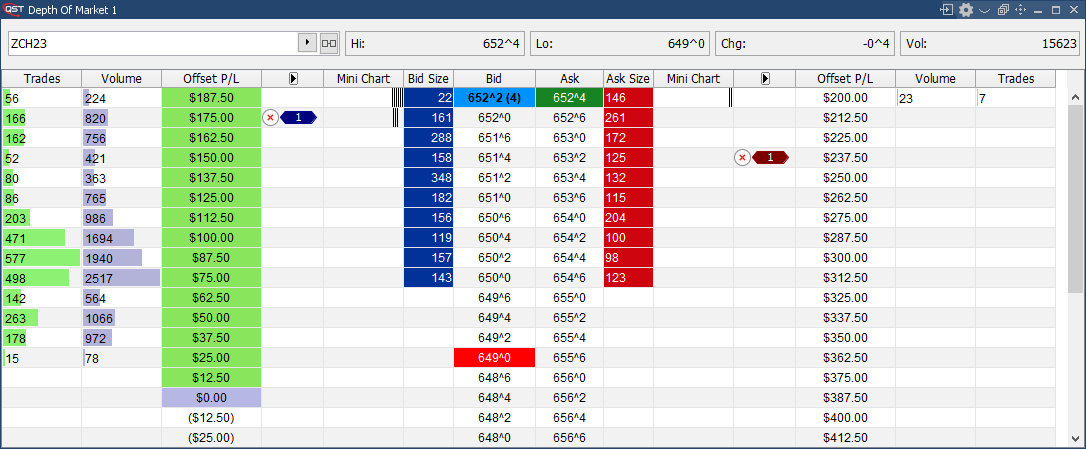

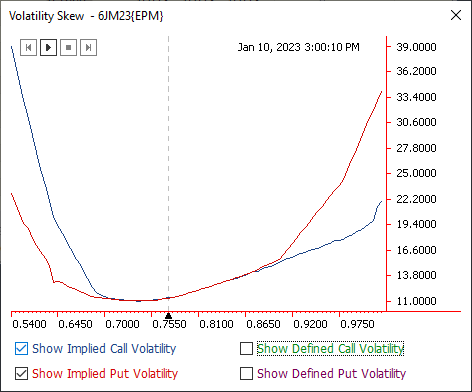

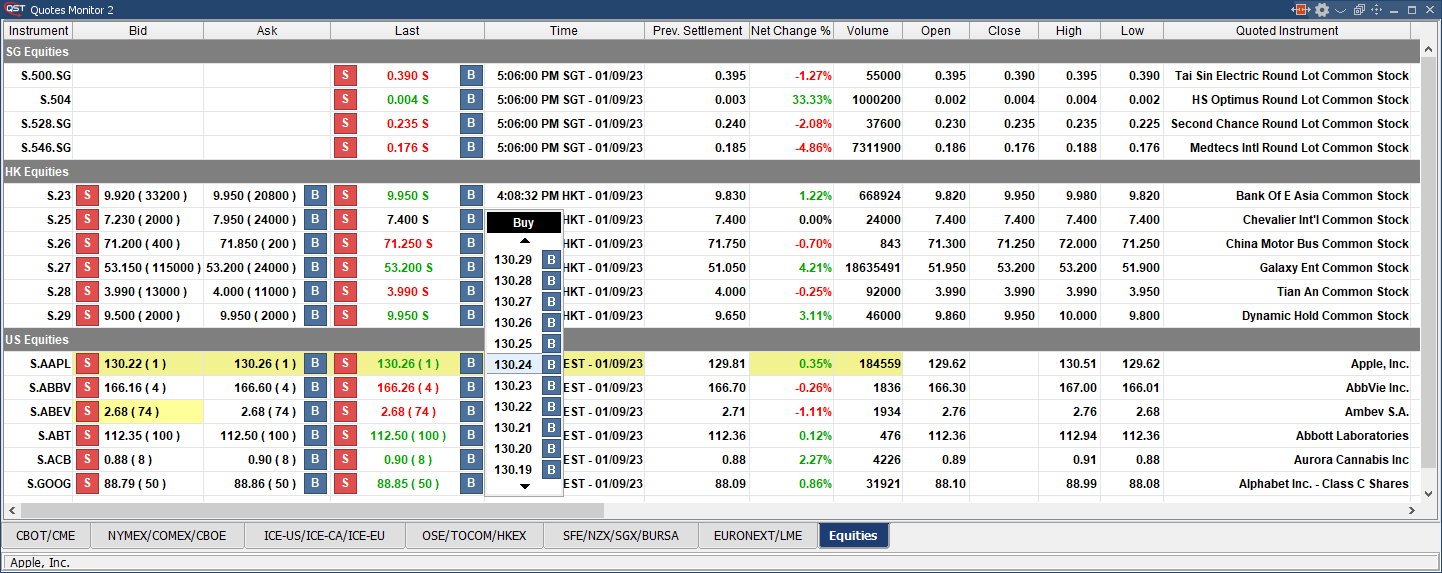

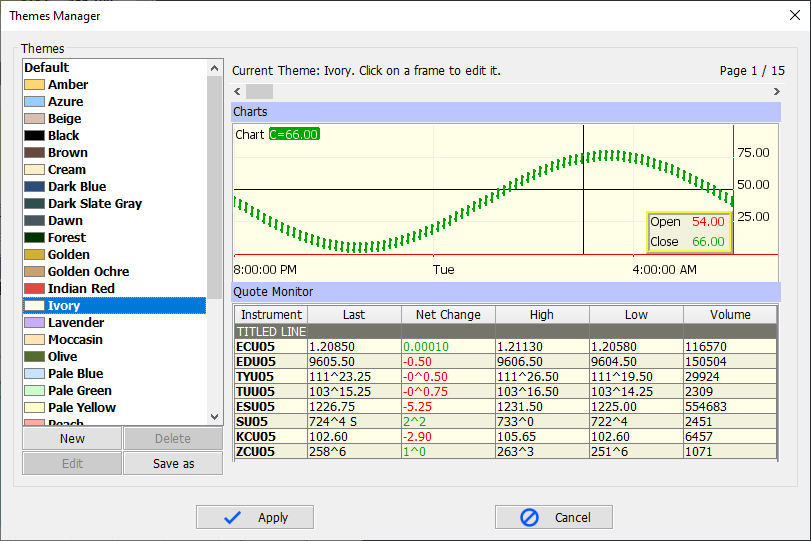

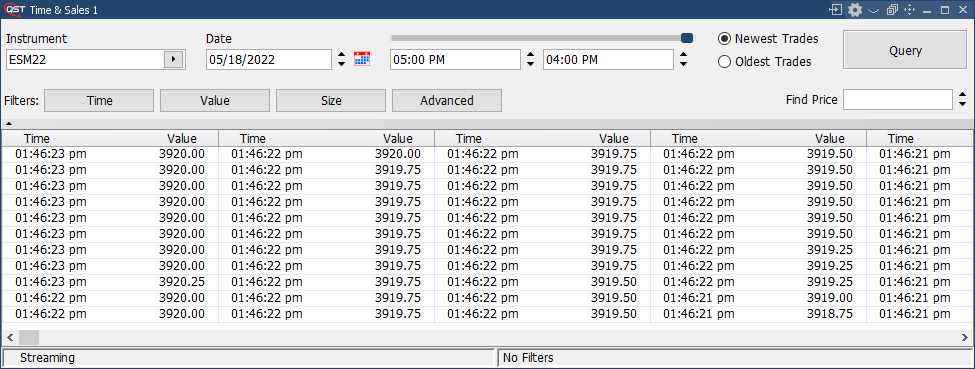

Real-time market data backed up by 24/5 customer service

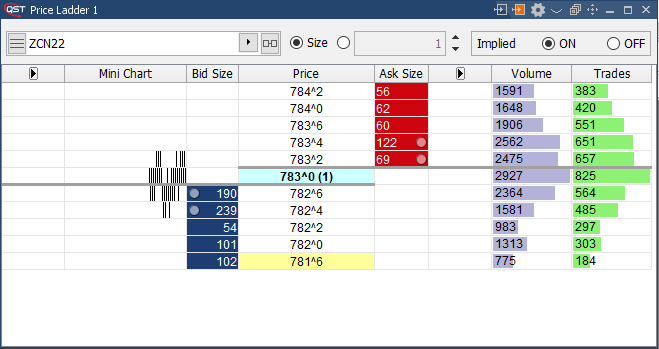

QST FIX Market Data API, based on the FIX 4.4, using TCP-Socket

QST Binary Market Data API, based on GPB (Google Protocol Buffers), using Secure WebSockets

End-to-end solutions backed up by a reliable customer service.

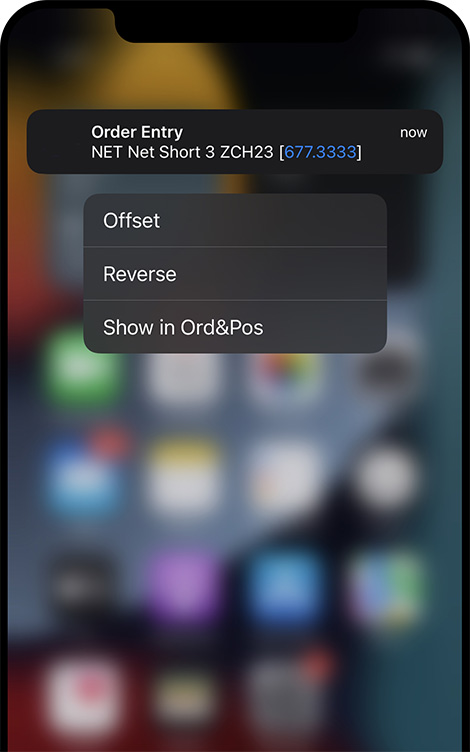

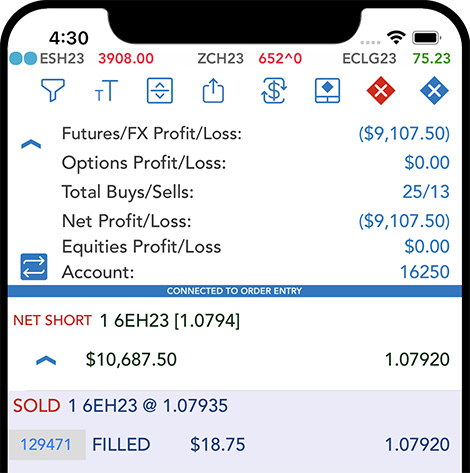

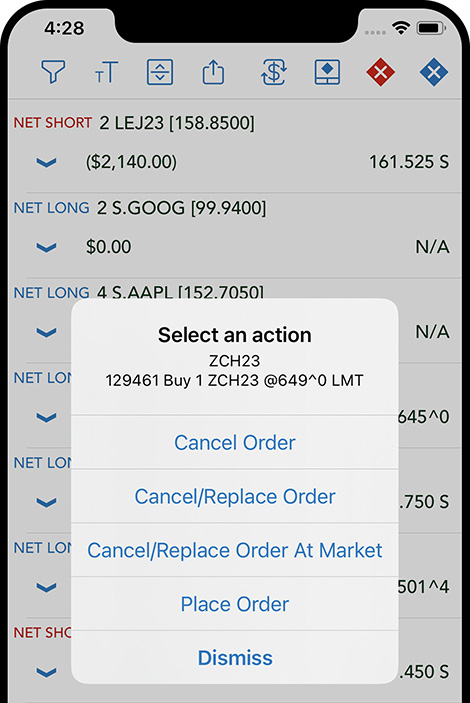

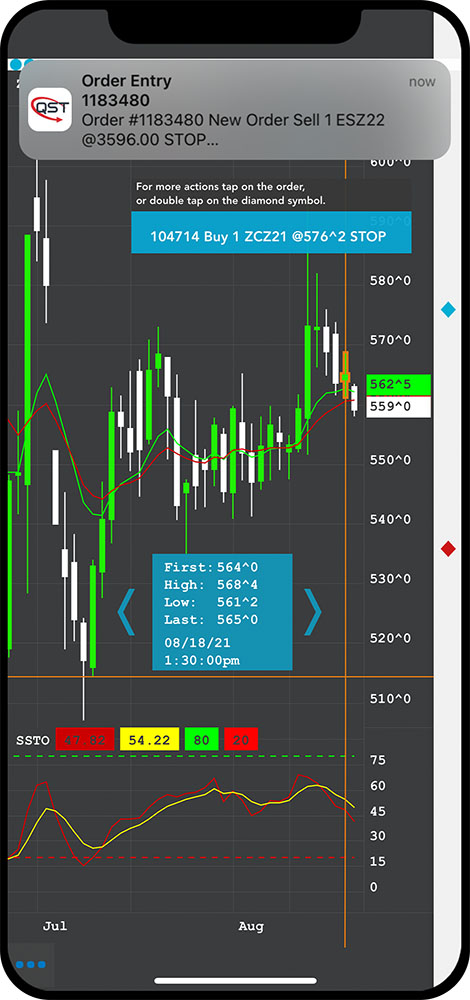

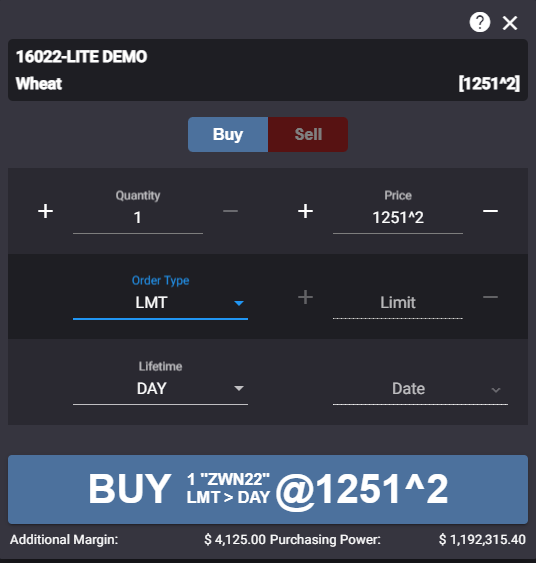

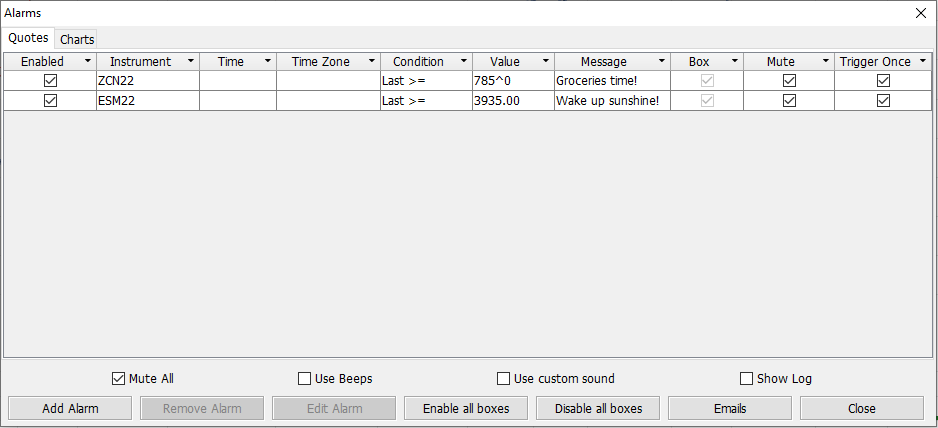

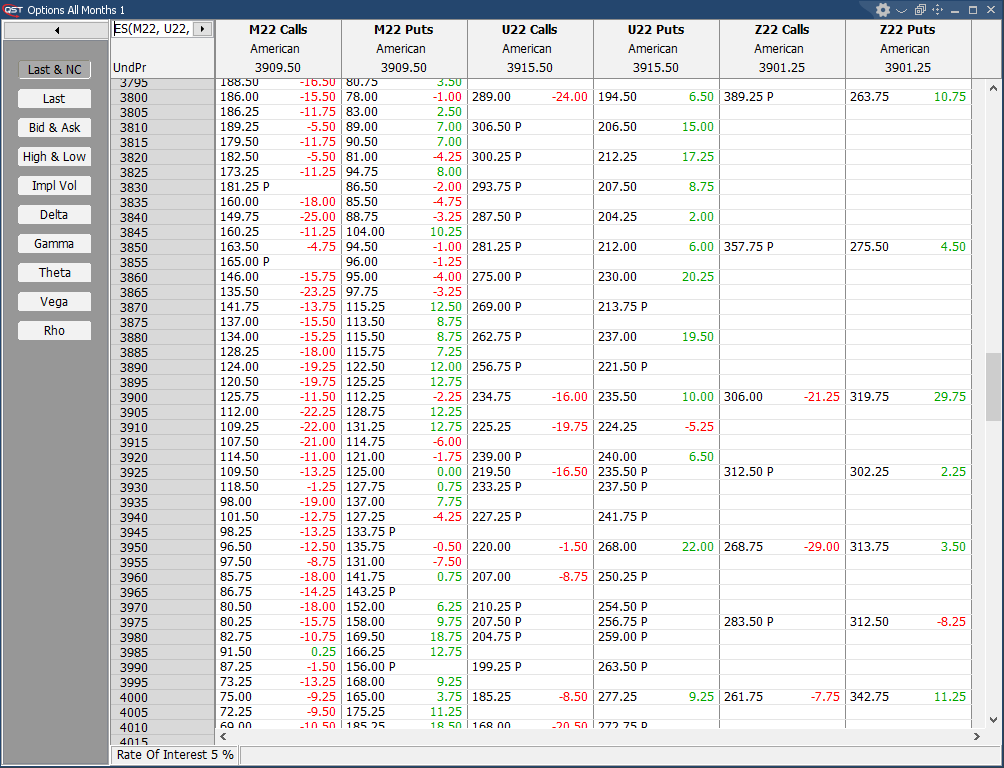

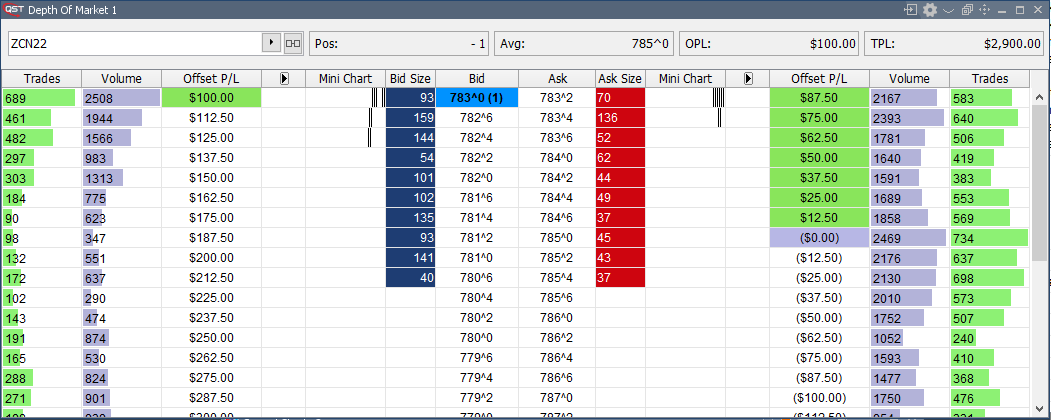

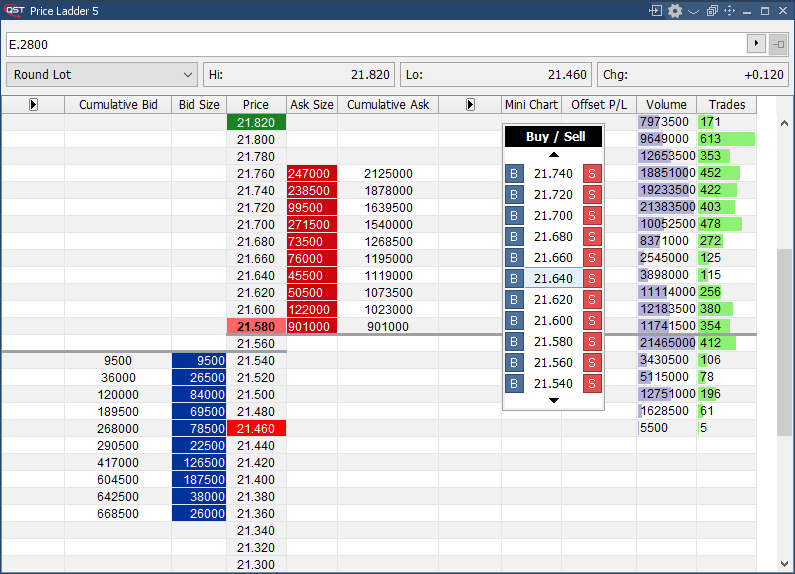

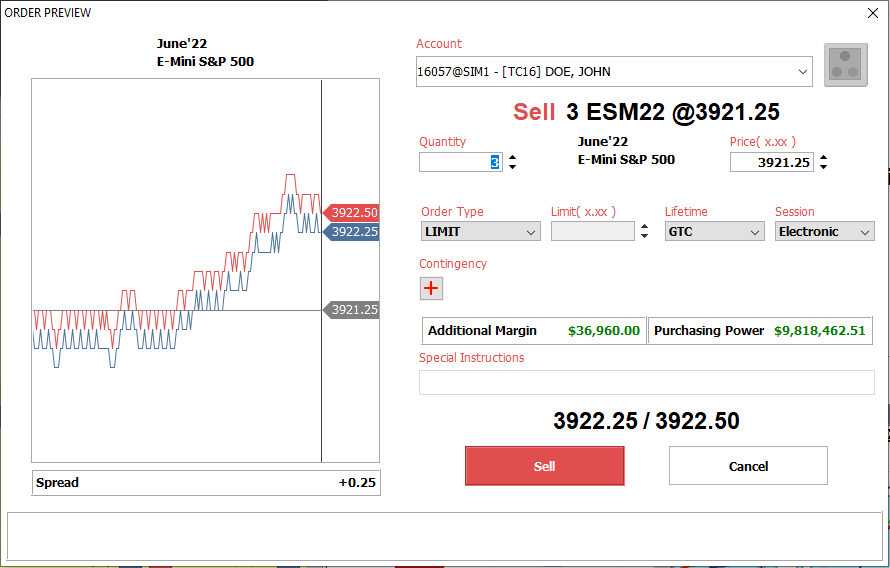

Order routing, the fastest in the industry with accurate pre-trade risk

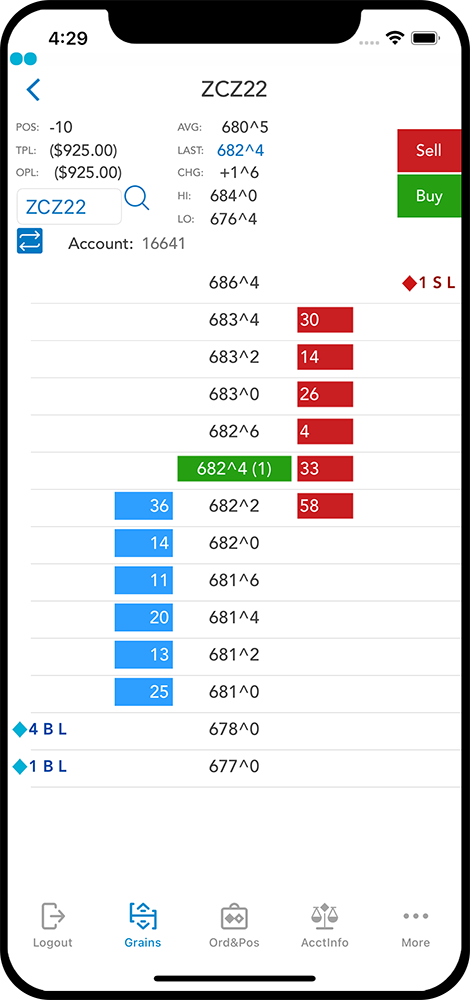

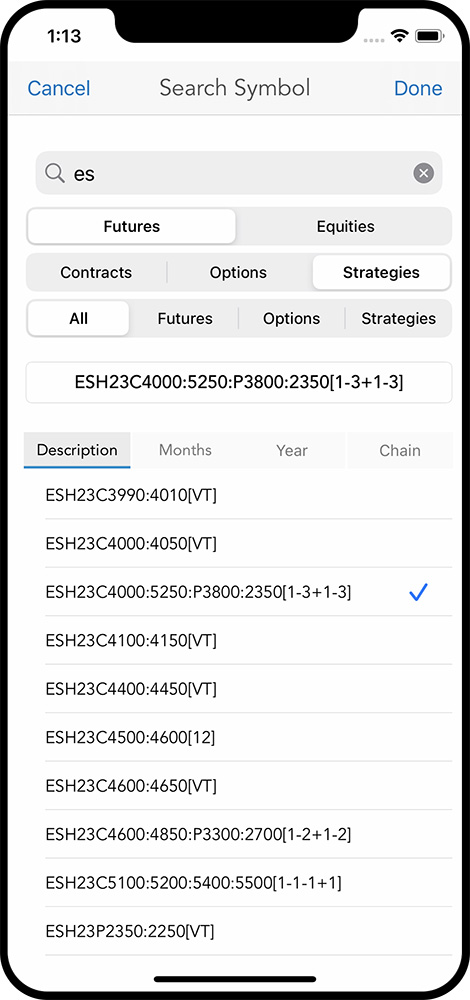

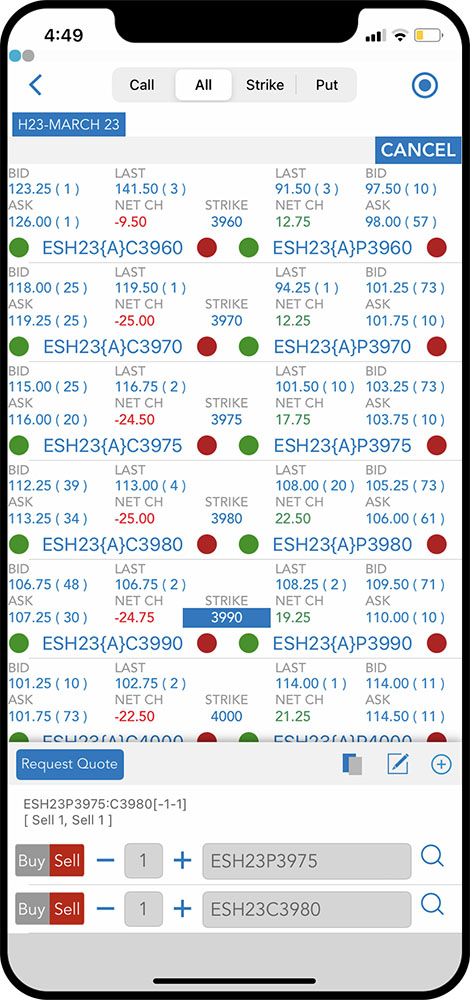

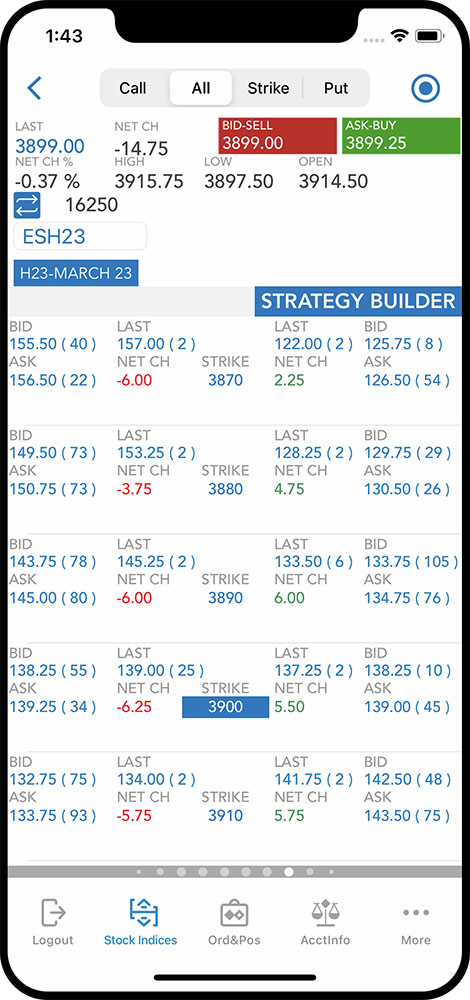

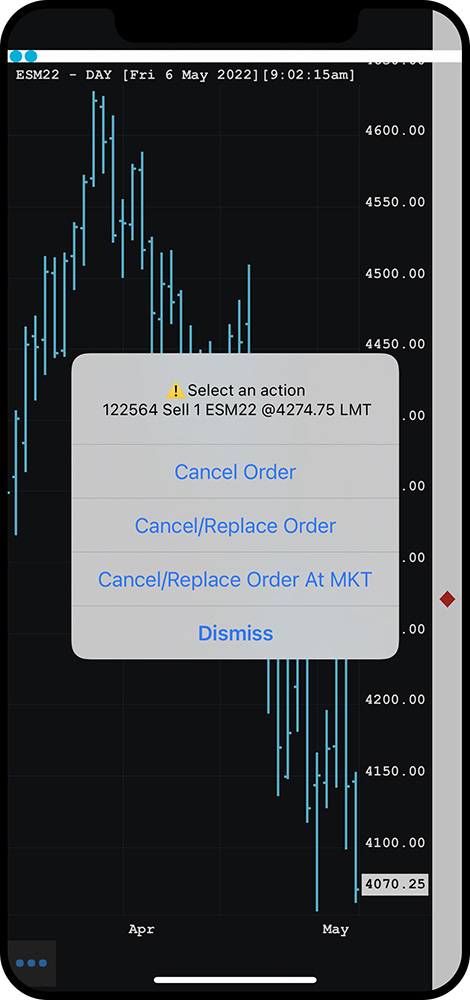

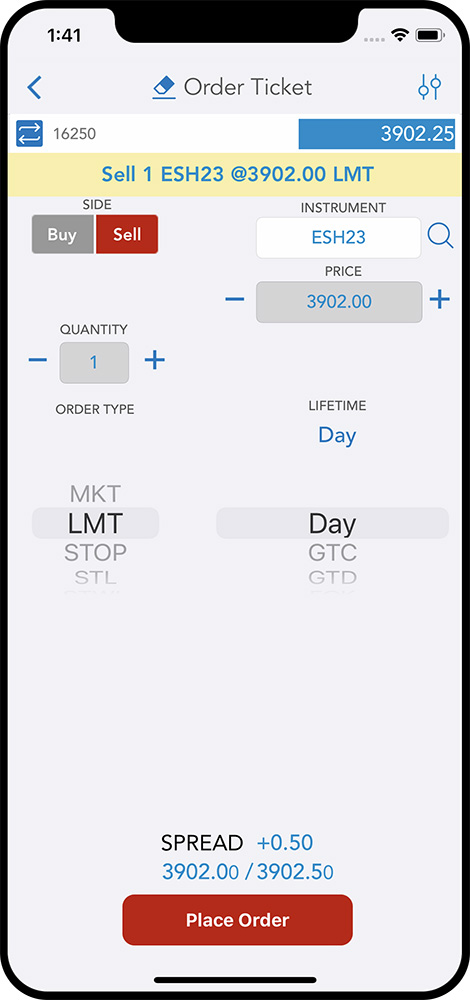

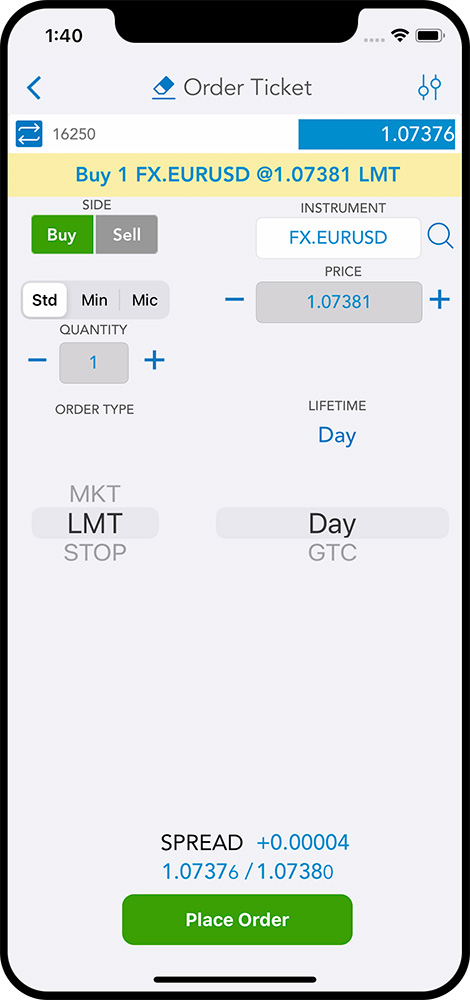

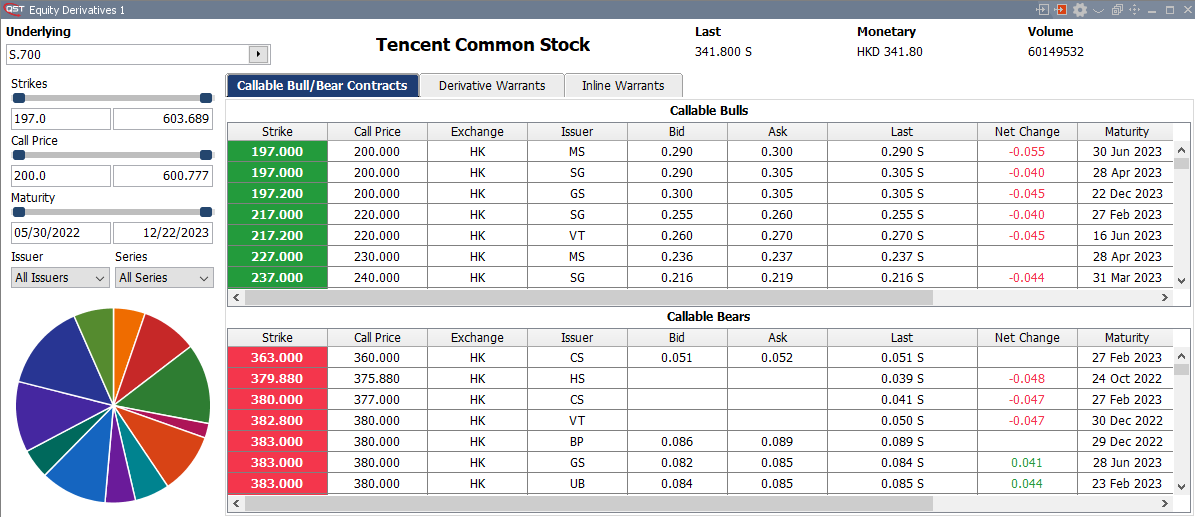

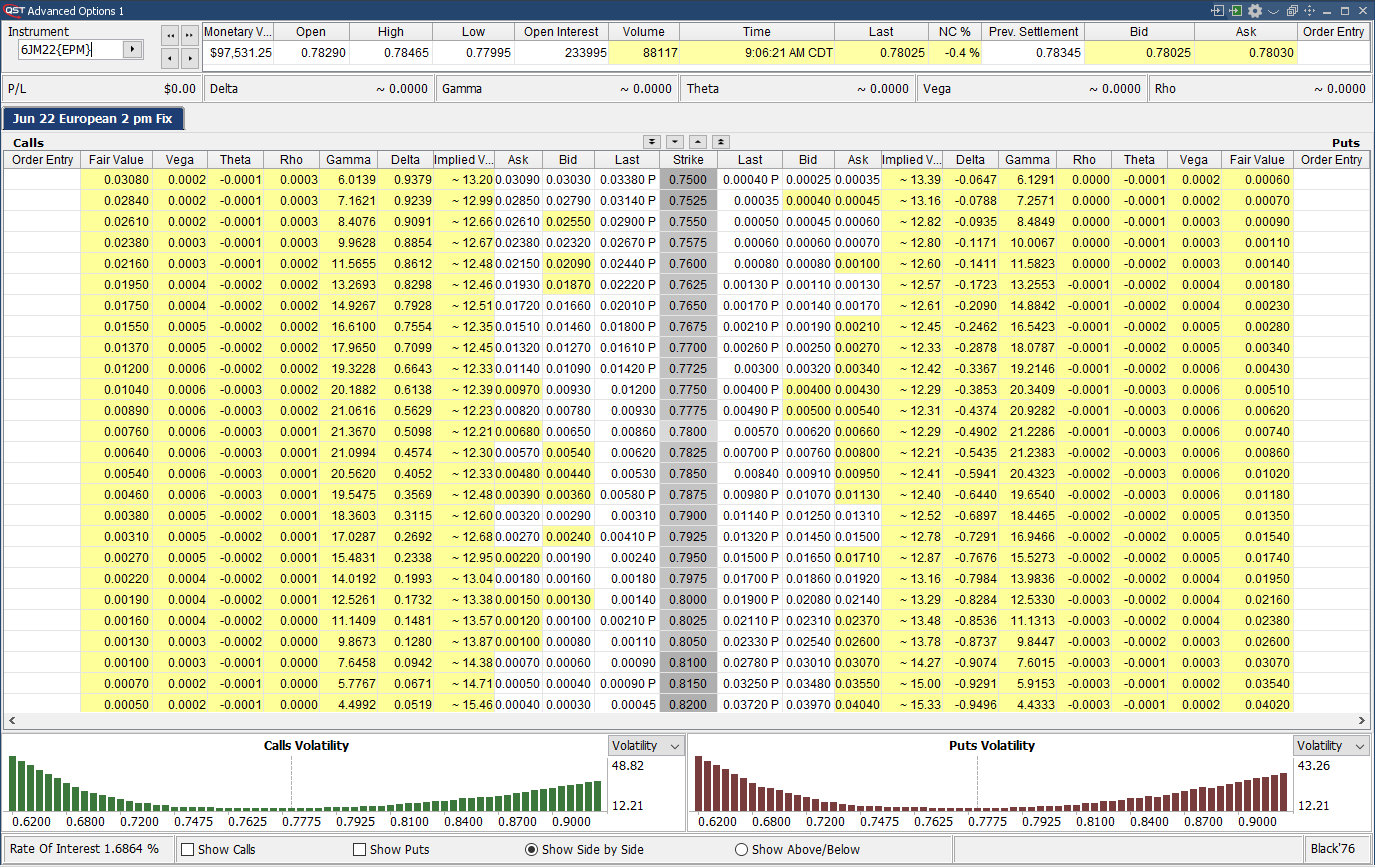

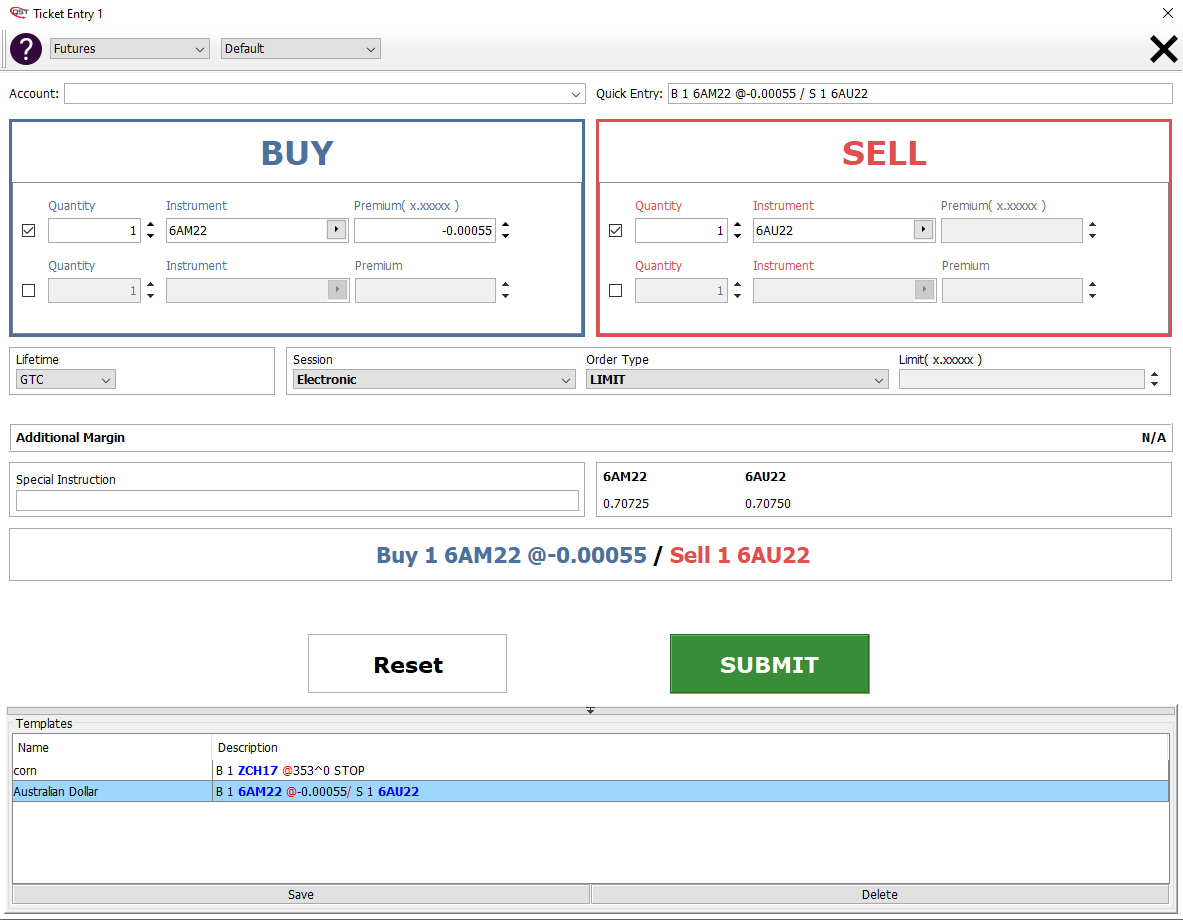

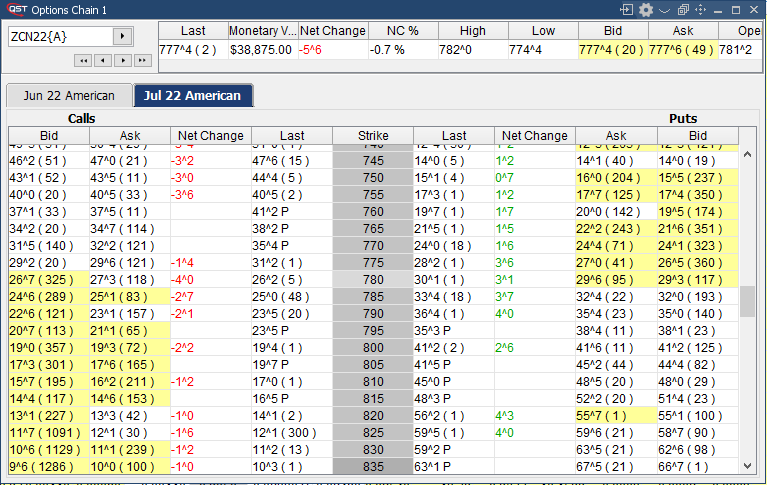

QAPI offers order routing APIs containing accurate pre-trade risk controls including outrights, short options, and strategy

QST FIX API Order Routing API, based on the FIX 4.4, using TCP-Socket

Clients can trade complex options and strategies with the reassurance that they are within their risk parameters, and firms can allow their clients to trade with the confidence that they will not overtrade

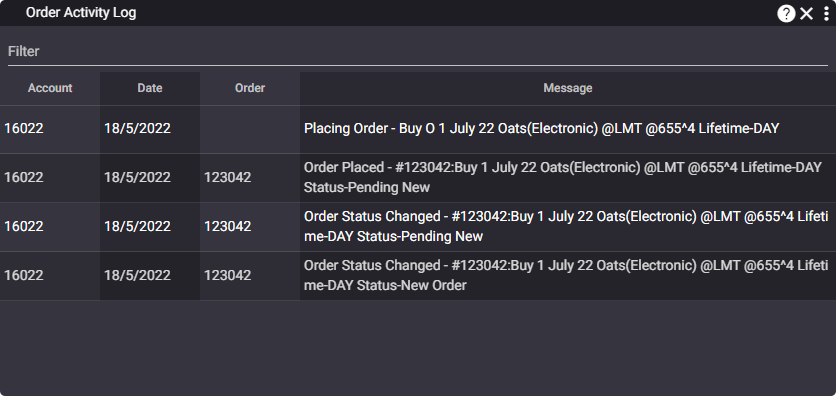

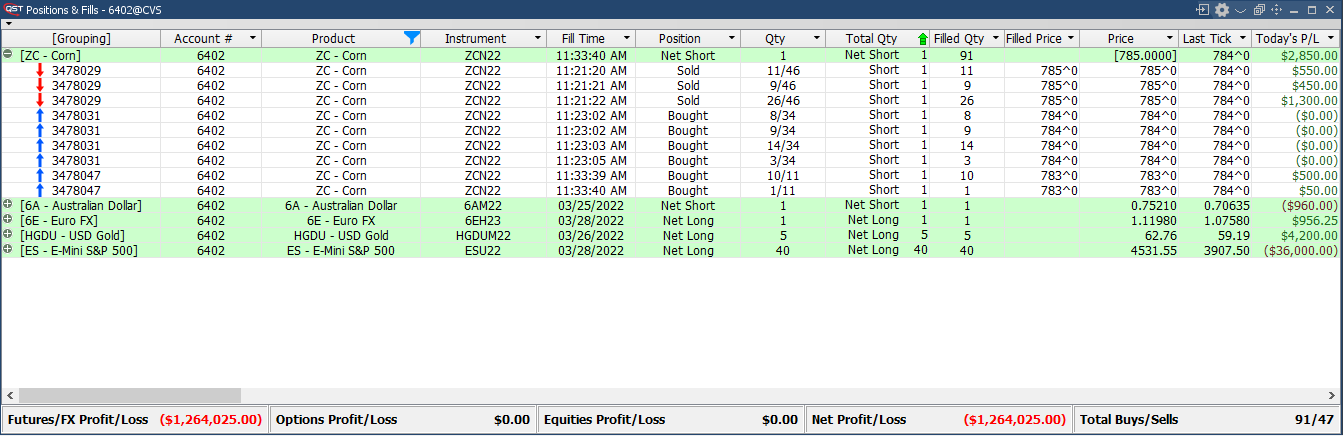

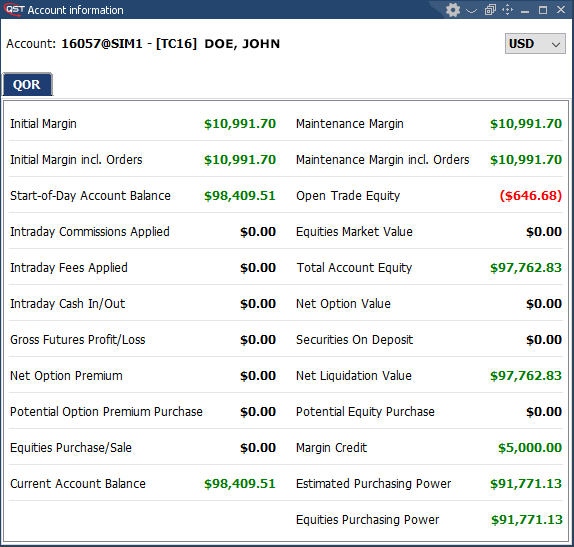

Automation API, JSON based API offers advanced back office data management for applications, platforms and proprietary systems.

Automation API, offers:

User/account management

Cash management (deposits/ withdrawals transfers)

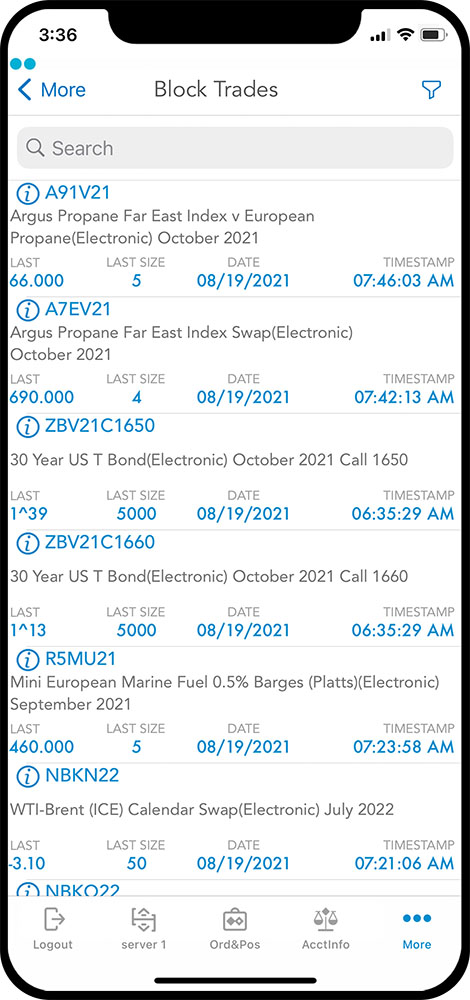

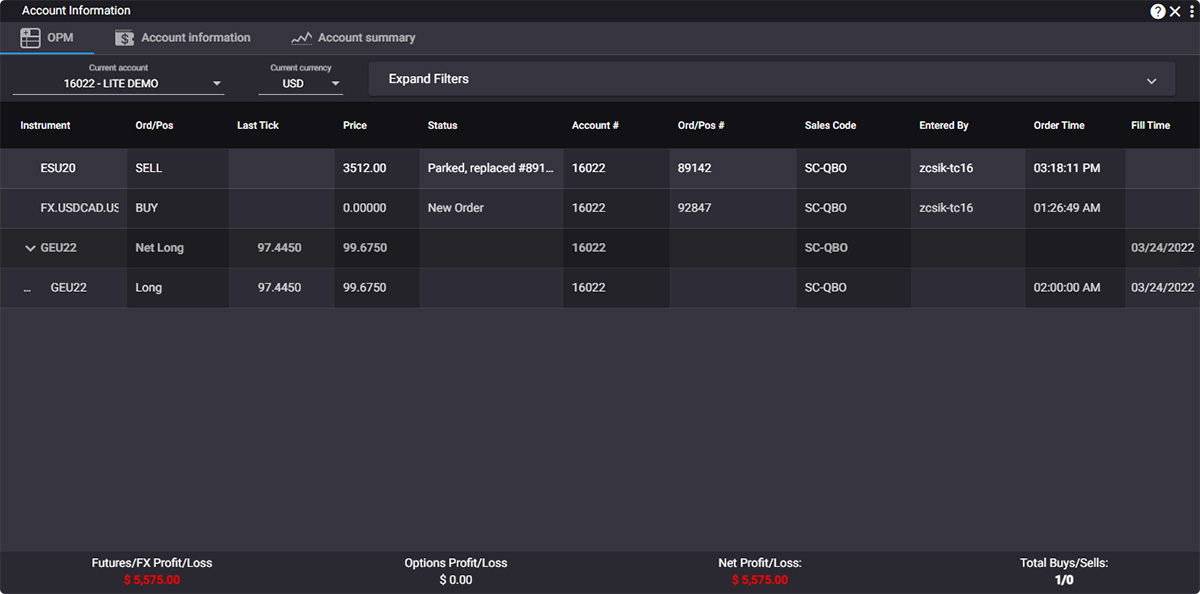

Trading activity

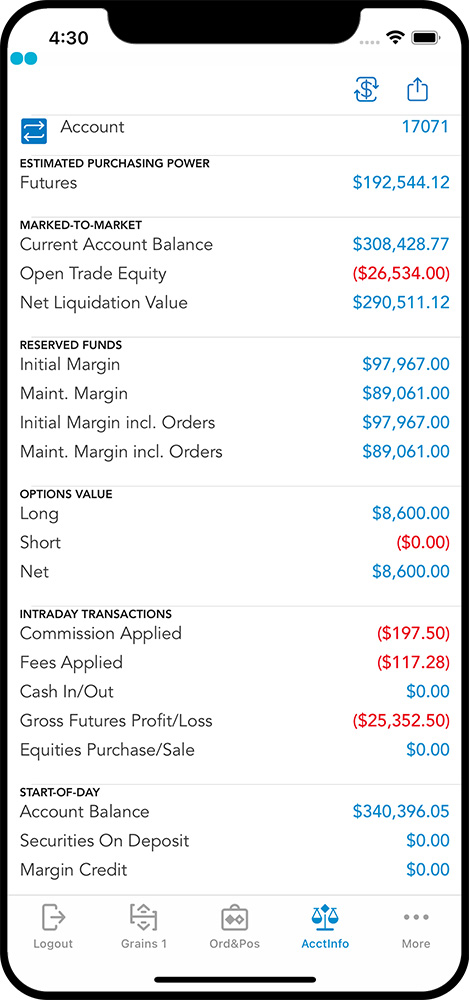

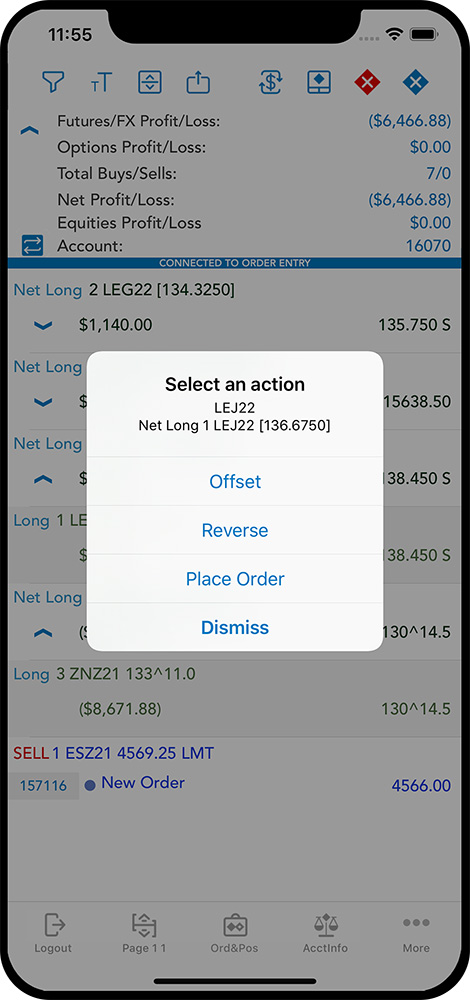

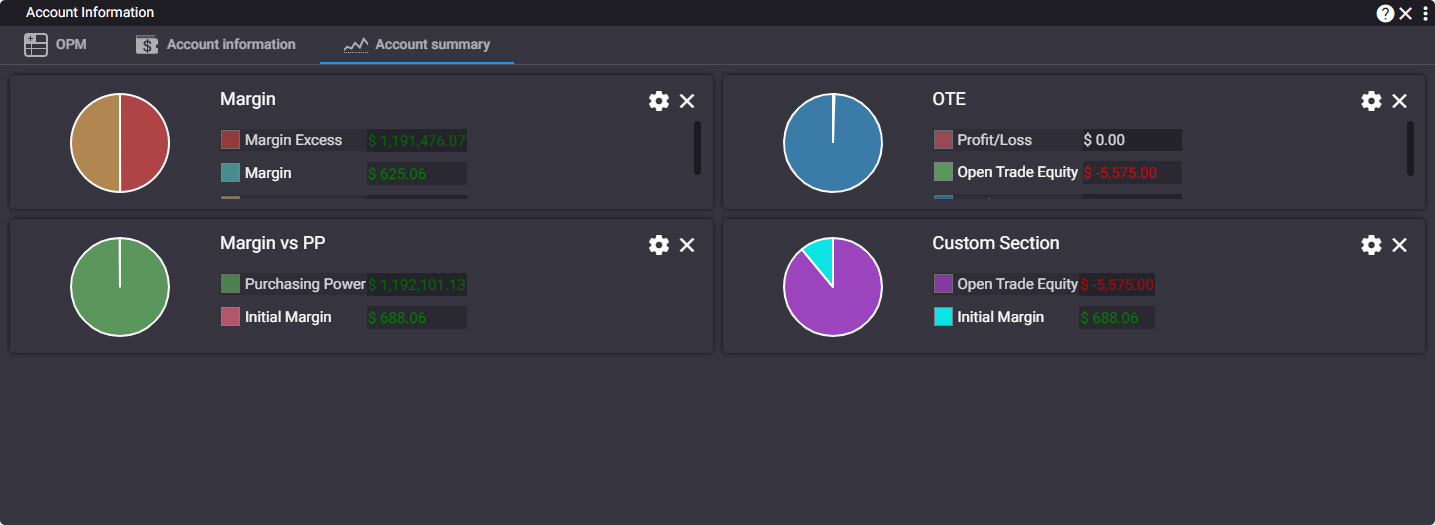

Real-time portfolio information

Statements/ reports management

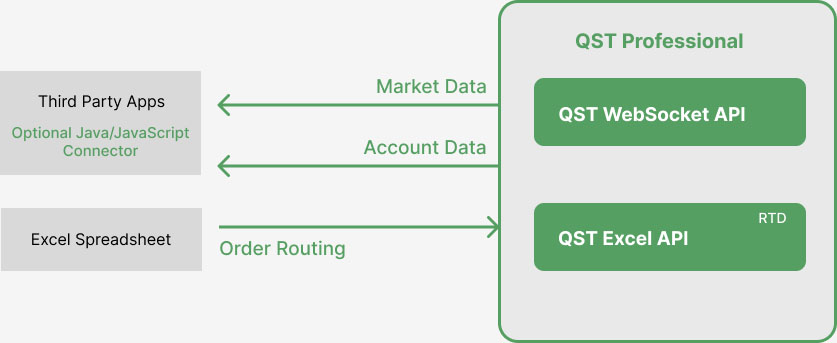

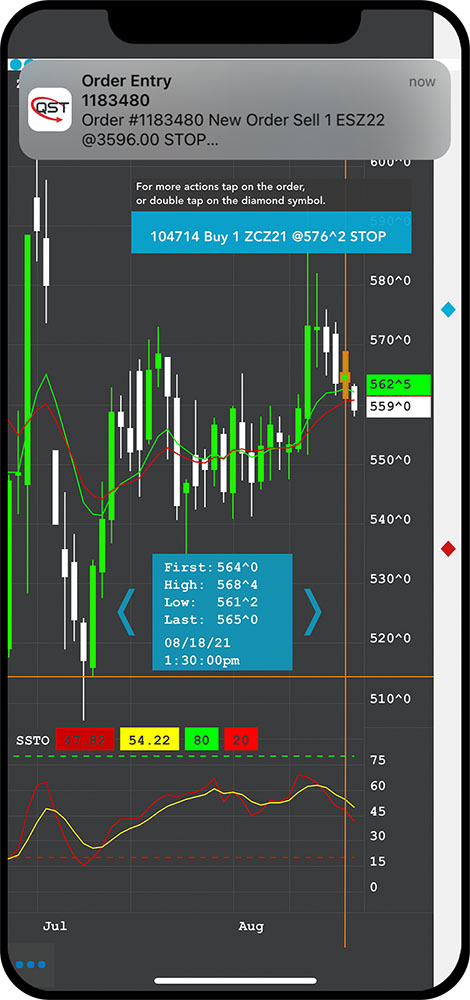

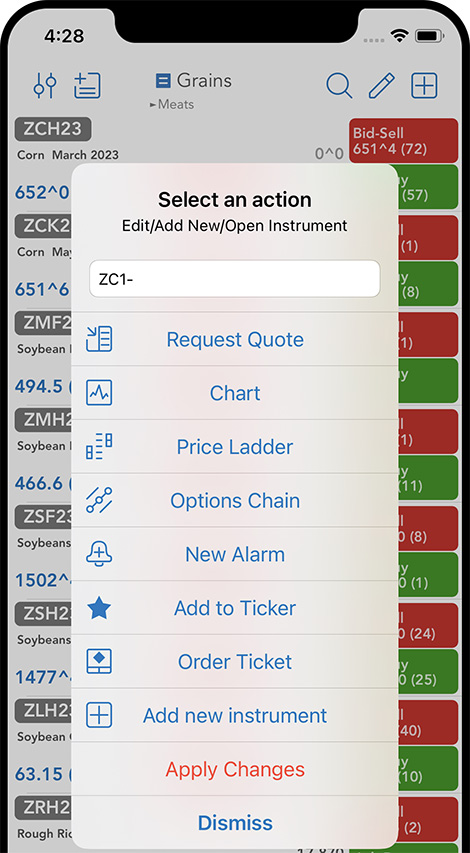

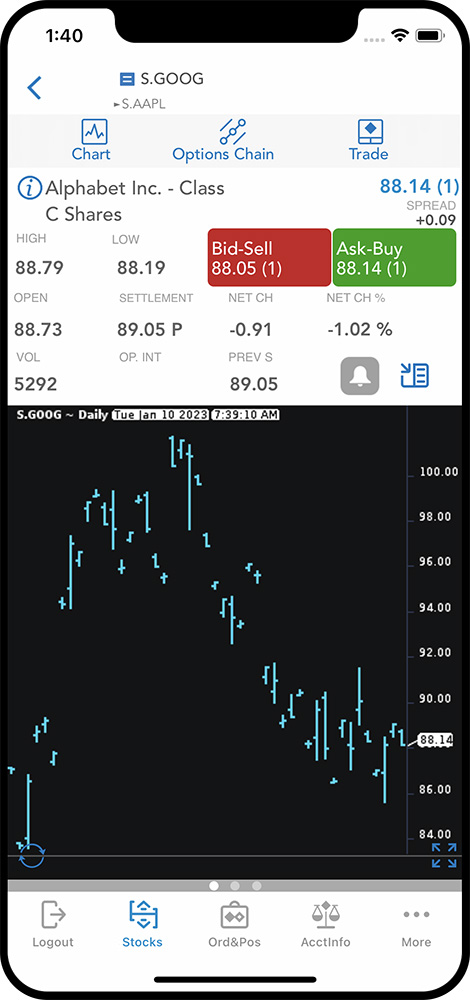

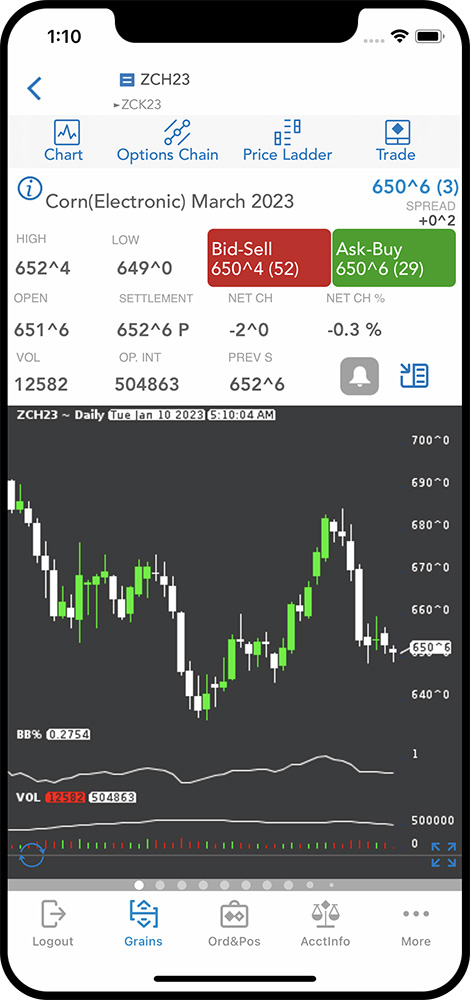

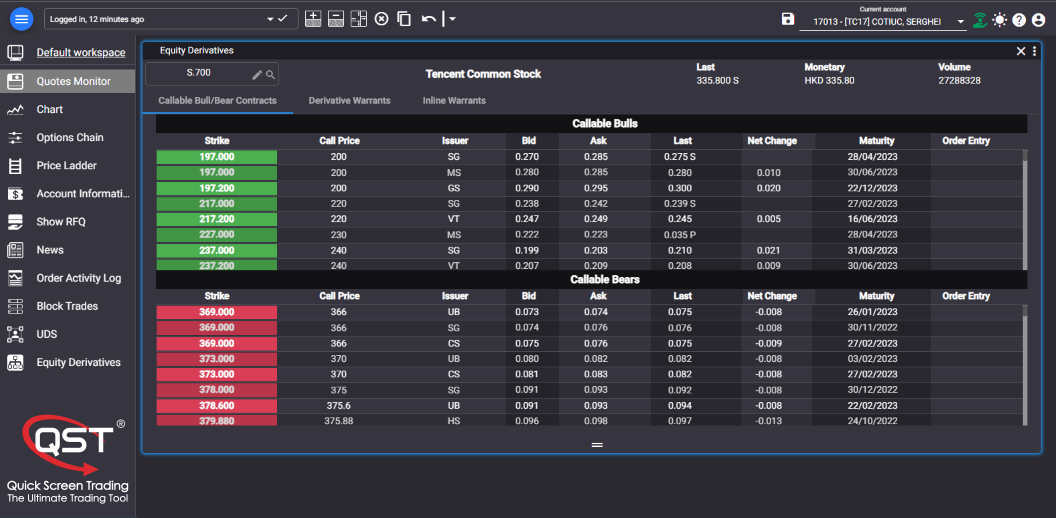

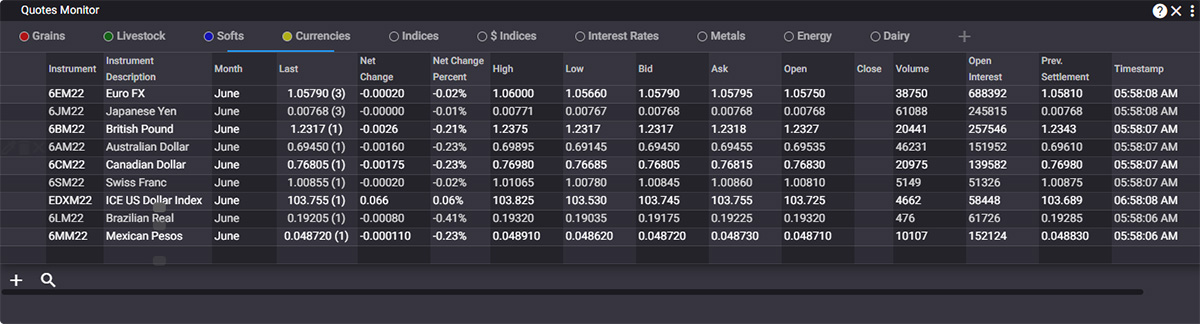

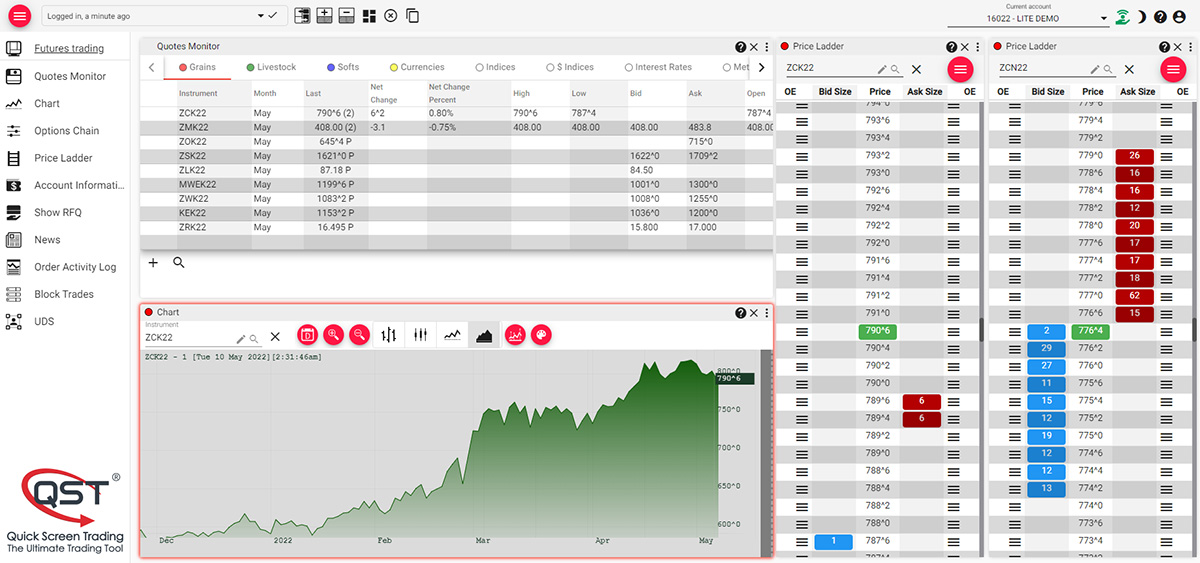

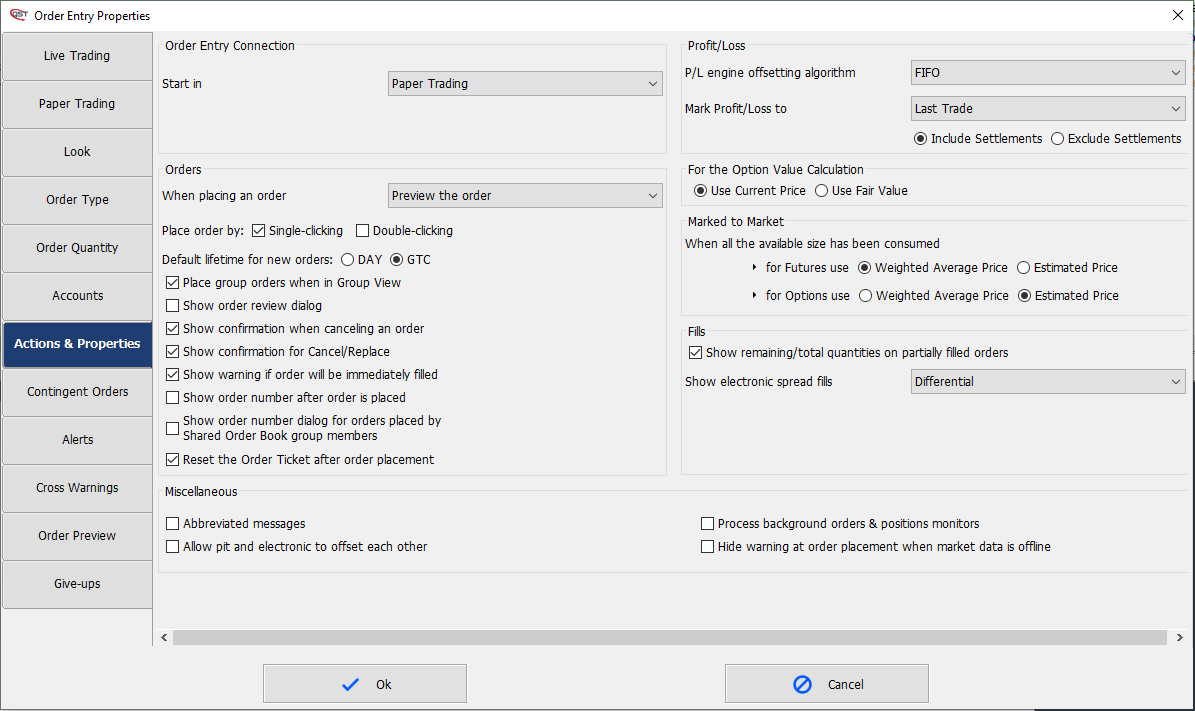

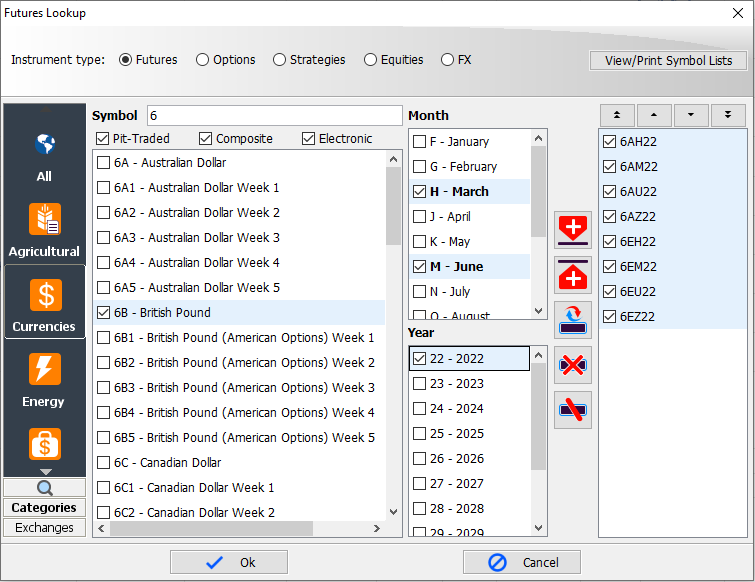

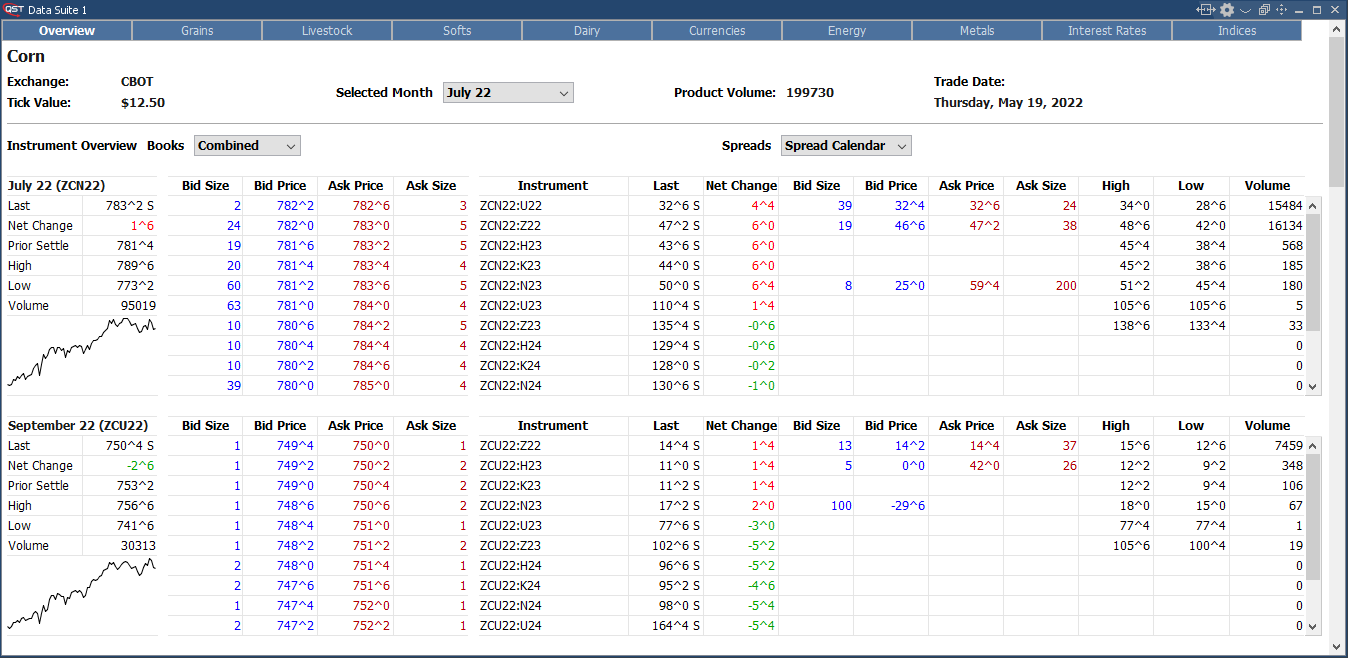

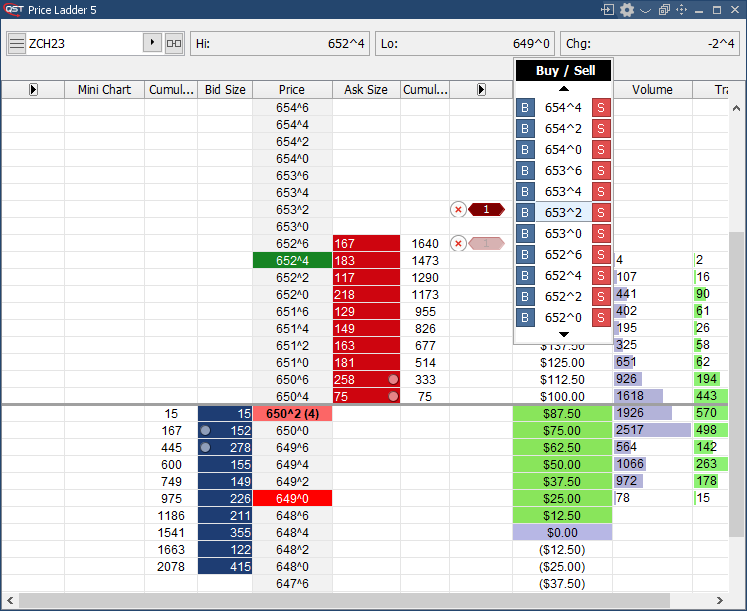

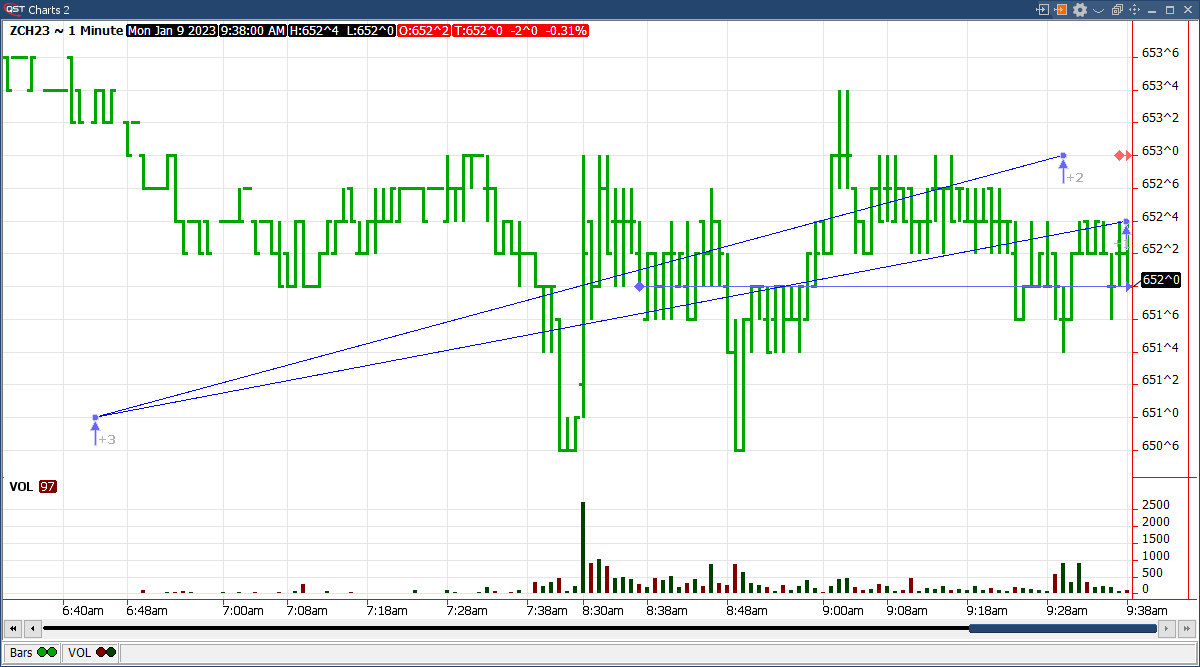

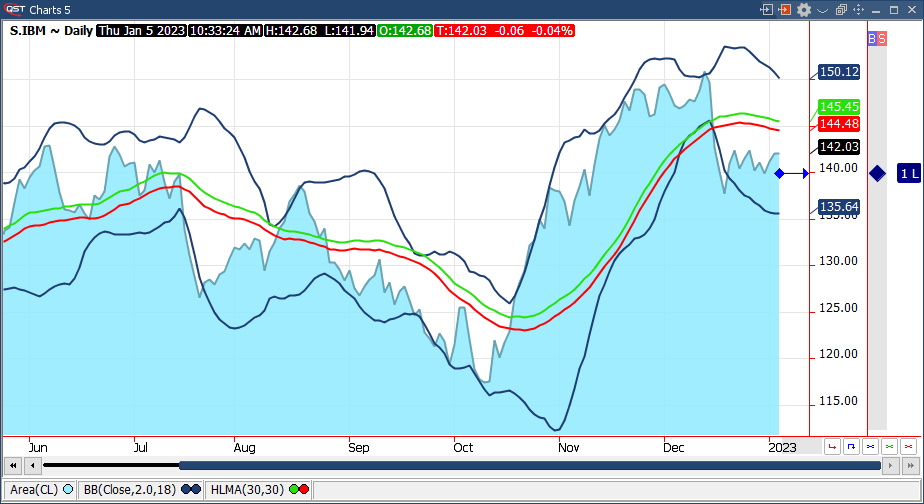

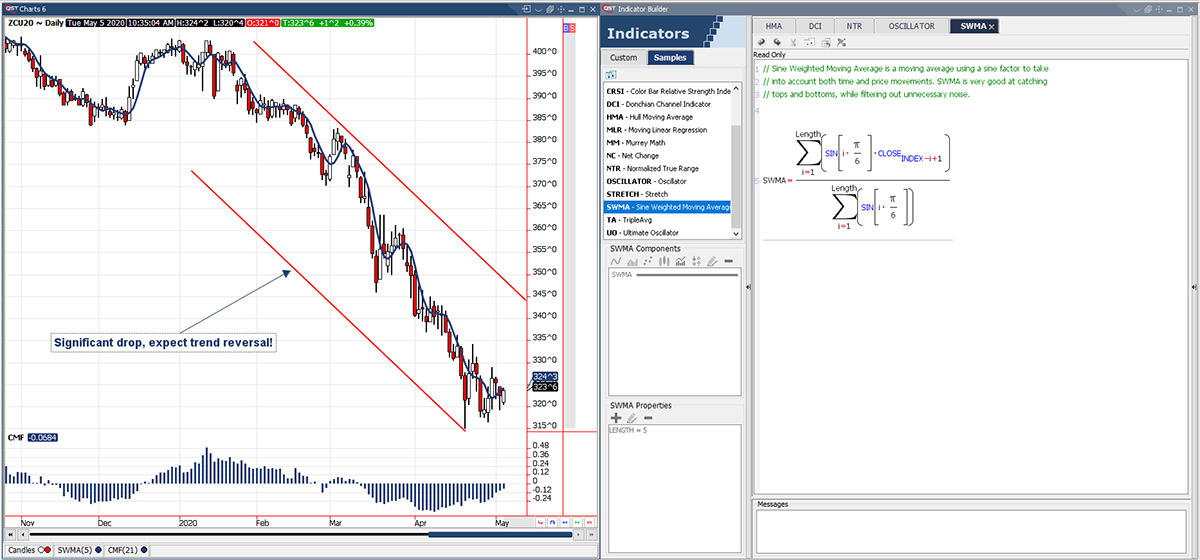

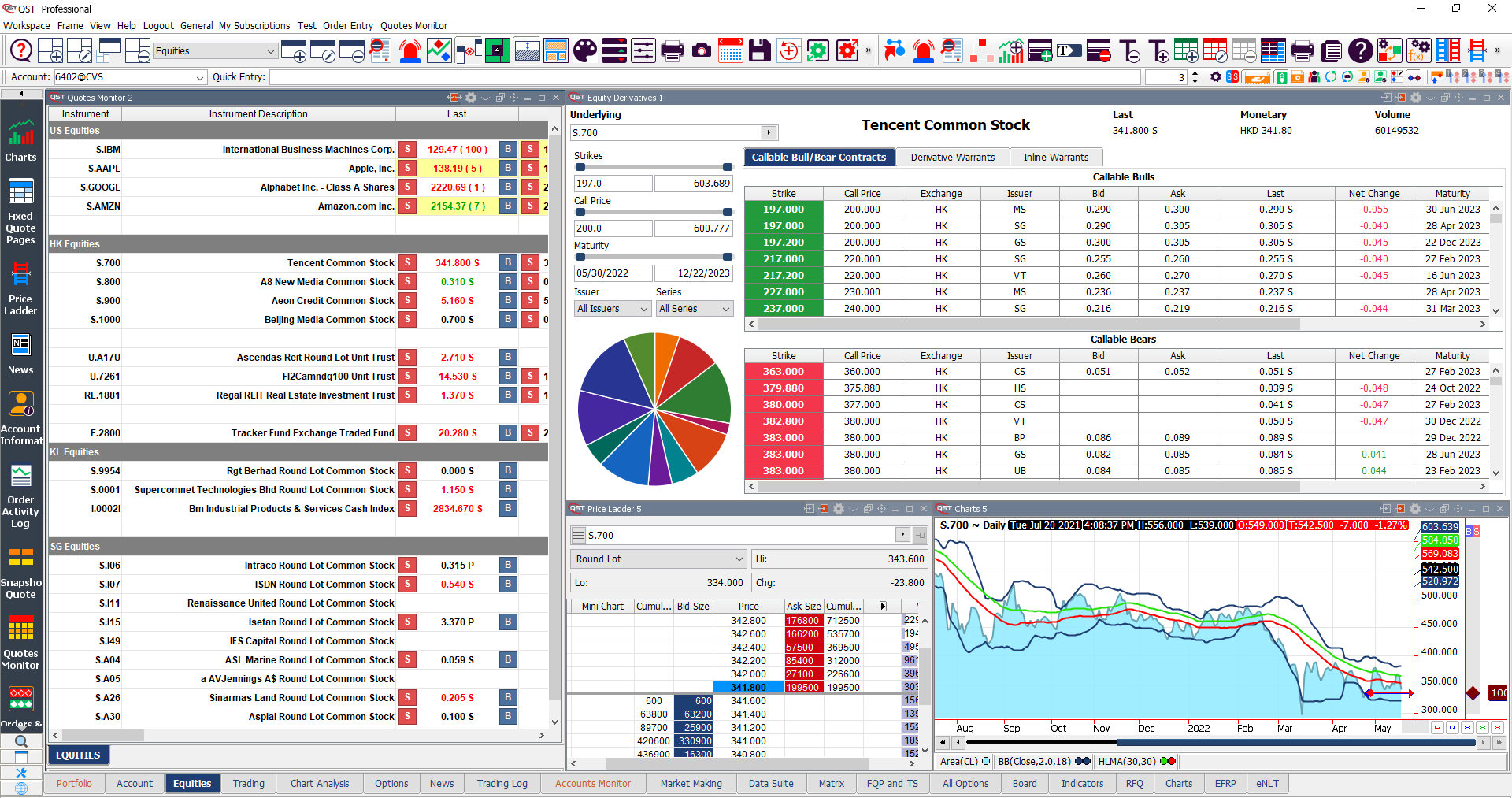

Our flagship front-end trading platform offers end-user applications that connect to a local instance running on their PC.

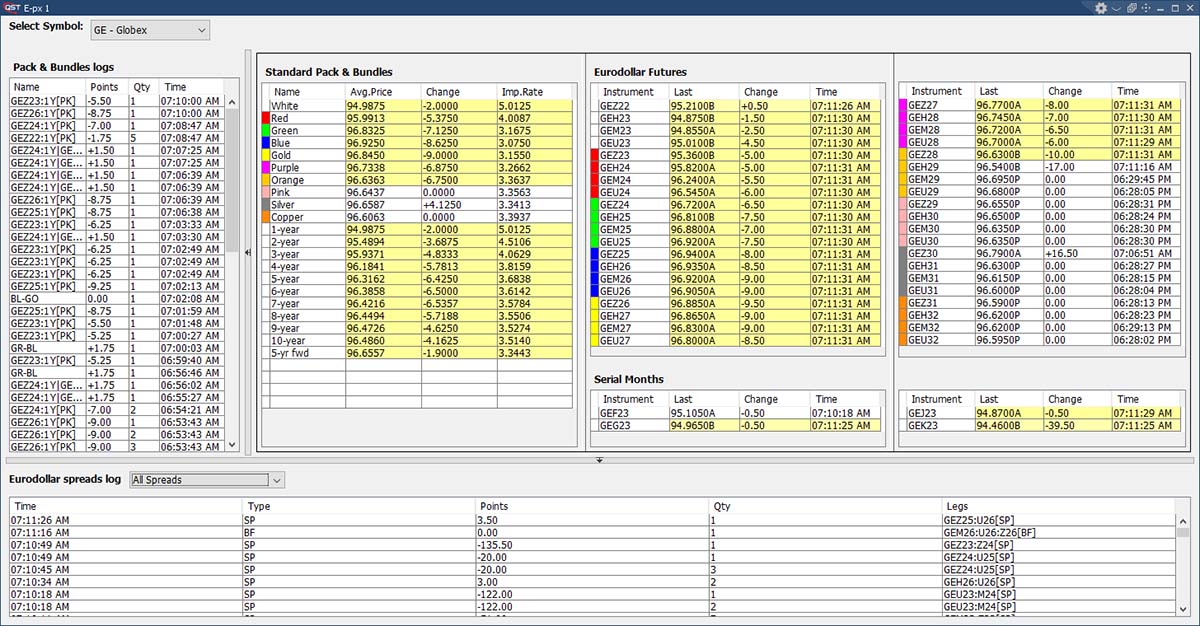

QST Professional provides real-time market data and order routing using:

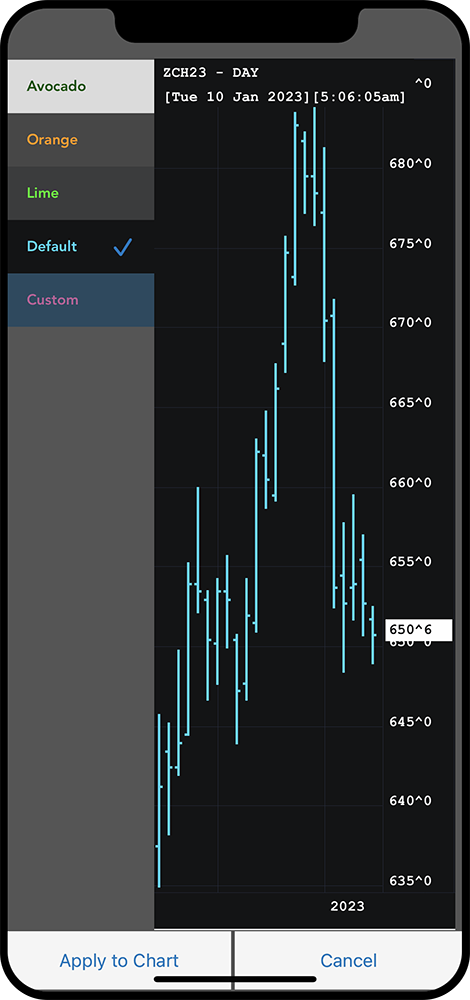

QST WebSocket API (WebSocket with JSON), offering market data, trade actions, charts with indicators and much more.

2. Optional JavaScript connector

QST Excel API, powered by QST Professional is a fast&easy solution to monitor quotes and manage trades from your own Microsoft Excel spreadsheets

QAPI is part of the QST solutions suite

QAPI integrates seamlessly with our front-end trading platform, back office and OMS